- AlphaInsights by 8alpha.ai

- Posts

- The Year of the Mega-Round

The Year of the Mega-Round

Week of December 22nd, 2025

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Security And Energy Deals Top The List (Crunchbase, 5 minute read)

Databricks (Data & AI): Databricks raised over $4 billion in a Series L financing at a $134 billion valuation, led by Insight Partners, Fidelity, and J.P. Morgan Asset Management, as the company reported a $4.8 billion revenue run rate and 55%+ year-over-year growth

Cyera (Cybersecurity): New York–based Cyera secured $400 million in funding led by Blackstone at a $9 billion valuation, bringing total capital raised by the AI-powered data security company to $1.7 billion

Radiant (Nuclear Power): Radiant raised over $300 million in Series D funding led by Draper Associates and Boost VC to scale its portable nuclear microreactors and build a new manufacturing facility in Oak Ridge, Tennessee

Tebra (Healthcare Software): Healthcare software provider Tebra raised $250 million in equity and debt financing, led by Hildred Capital Management with debt from J.P. Morgan, to invest in AI-driven automation for private medical practices

Imprint (Fintech): Fintech startup Imprint raised $150 million in Series D funding at a $1.2 billion valuation, led by Khosla Ventures, to expand its branded credit card platform for consumer companies

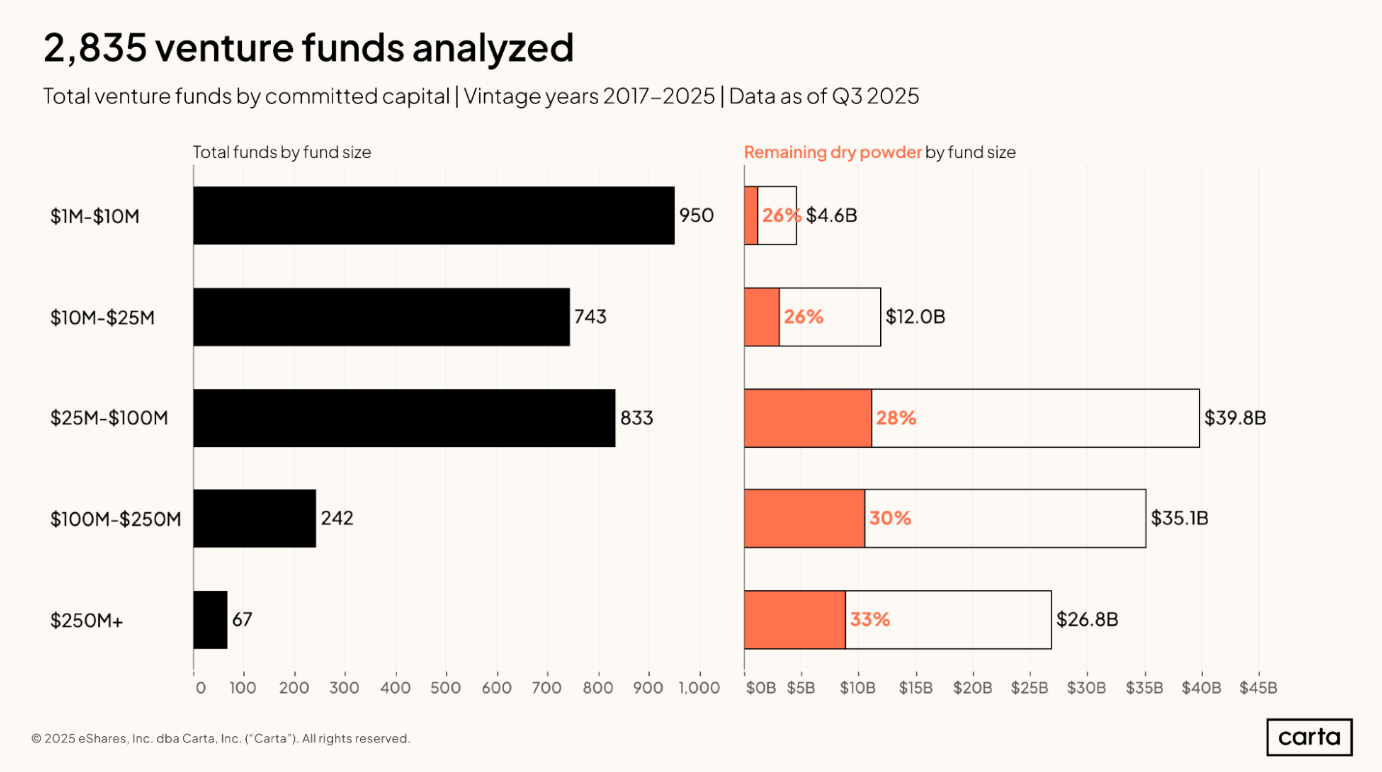

Q3 2025 VC Fund Performance (Carta, 3 minute read)

In venture capital, a 3x TVPI is often treated as the gold standard for fund performance, but for most funds raised since the late 2010s, it remains difficult to attain. While top-tier funds continued to perform well during Q3, 90th-percentile TVPI stands at 3.52x for 2017 vintages and 3.07x for 2018, the broader market lags, with median TVPI at 1.76x (2017) and 1.38x (2018), and even lower for vintages 2019 onward, where 2x+ returns are rare. This reflects longer holding periods as startups stay private and exits remain slow, though momentum is gradually improving:

42% of 2020 funds and 25% of 2021 funds have begun distributing capital, and median IRRs for 2021 (0.5%) and 2022 (0.1%) have turned positive

With most pre-2021 funds now 83%–89% deployed and significant dry powder still held by newer vintages

Some funds are likely to grow into strong outcomes, but many will fall short of the 3x TVPI mark LPs are watching closely

OpenAI is reportedly trying to raise $100B at an $830B valuation (TechCrunch, 2 minute read)

OpenAI is reportedly in talks to raise up to $100 billion in a new funding round that could value the company as high as $830 billion, up from about $500 billion in its most recent secondary transaction. The round, which could close by Q1 next year, may include sovereign wealth funds and is aimed at supporting OpenAI’s rapidly rising compute and inferencing costs as it races rivals like Anthropic and Google. The company is generating roughly $20 billion in annualized revenue

However, OpenAI faces growing scrutiny as investor sentiment around debt-heavy AI investment cools and chip supply constraints persist

OpenAI is also rumored to be exploring a future IPO and additional strategic investments

These include a potential $10 billion deal with Amazon as it seeks to fund what could amount to trillions of dollars in long-term AI infrastructure spending

6 Charts That Show The Big AI Funding Trends Of 2025 (Crunchbase, 4 minute read)

AI dominated global startup funding from 2023 through 2025, reaching a new peak in 2025 as nearly 50% of all venture capital flowed into the sector, up from 34% in 2024, with total AI investment hitting $202.3 billion, a 75%+ year-over-year increase. Funding concentrated heavily at the top: foundation model companies raised $80 billion (about 40% of AI funding), led by OpenAI ($500B valuation) and Anthropic ($183B), which together account for nearly 10% of total unicorn value

The U.S. captured 79% of AI funding ($159B), with the San Francisco Bay Area alone raising $122B

Large rounds dominated, with 58% of AI funding coming from $500M+ megarounds

Private equity and alternative investors led the biggest checks, including SoftBank’s $40B investment in OpenAI, highlighting the growing scale and capital intensity of AI investing

ECONOMIC SNAPSHOT

Will AI And Stimulus Save The U.S. Economy As Job Market Softens? (Forbes, 5 minute read)

U.S. stocks have delivered strong gains in 2025, driven by expectations of earnings growth, solid economic activity, and optimism around AI. However, caution signals are emerging: consumer confidence has fallen to recession-like levels, unemployment rose to 4.4% in September from a 3.4% low in April 2023, job postings and openings continue to decline, and continuing unemployment claims are trending higher. Despite this, markets are pricing in low recession risk, with cyclical stocks and banks outperforming. Corporate profits are still growing year over year, and capital expenditures continue to rise, supported by heavy AI-related data center investment

Fiscal support is expected to strengthen in 2026, with federal tax refunds projected to jump 44%, providing a ~0.9% of GDP tailwind that largely offsets roughly 1% of GDP in tariff drag

The Federal Reserve has already cut rates by 1.75 percentage points, and markets expect two additional cuts in 2026

This supports a base case of no recession, though delayed data and a softening labor market remain key risks to watch

Federal Tax Refunds - Glenview Trust, Bloomberg

The U.S. economy was stagnant in 2025 — with one exception (Los Angeles Times, 4 minute read)

Public sentiment on the economy remains cautious, with about 75% of Americans saying it feels like the country is in a slowdown, even as headline growth has been supported by a narrow set of drivers. According to a Harvard analysis, roughly 92% of U.S. GDP growth this year came from capital spending by California-based tech companies on AI infrastructure, and other research estimates that about half of U.S. growth from Q2 2024 to Q2 2025 was tied to AI data centers. However, California lost 158,734 jobs, AI-driven cuts totaled ~48,000 layoffs nationwide, and state consumer confidence is at a five-year low

The top 10 S&P 500 stocks drove ~60% of market gains, while spending growth is led mainly by the top 10%-20% of households

The administration has backed $1T+ in AI investment, including $500B for data centers, but most capacity won't come online until 2026-2028

AI is lifting profits and GDP, but broad productivity gains are still modest, keeping growth narrowly tied to AI capital spending

Next Fed Chair in ‘No-Win Scenario’ as Selection Process Draws to a Close (The New York Times, 8 minute read)

President Trump’s selection process for the next Federal Reserve chair has narrowed primarily to Kevin Hassett, director of the National Economic Council, and Kevin Warsh, a former Fed governor who served from 2006 to 2011, as Chair Jerome Powell’s term ends in May 2026. The decision follows months of public discussion by the White House and comes amid heightened attention to interest rates, Fed independence, and market credibility. Hassett was initially seen as the leading candidate but has faced questions about his closeness to the White House, while Warsh has picked up support from parts of the financial community despite previously stressing inflation risks and policy restraint

Other candidates, including current Fed governor Christopher Waller, whose term runs through 2030, remain under consideration

The eventual nominee will lead the 12-member Federal Open Market Committee, which has shown greater divisions in recent votes

The role will begin amid ongoing legal, economic, and policy debates that could shape how markets view the Federal Reserve’s independence and future policy direction

New York Signs AI Safety Bill Into Law, Ignoring Trump Executive Order (The Wall Street Journal, 3 minute read)

New York Gov. Kathy Hochul has signed the Responsible AI Safety and Education (RAISE) Act, a law requiring large AI developers to adopt and disclose safety practices. Beginning Jan. 1, 2027, companies with more than $500 million in annual revenue that develop large AI systems must publish and follow safety protocols to prevent critical harm and report serious incidents within 72 hours, or face fines. The law creates a new enforcement office within the New York State Department of Financial Services to issue rules, assess fees, and publish annual AI safety reports

The law advances despite a recent federal executive order aimed at limiting state-level AI regulation

It is modeled in part on California’s SB53 law but includes stricter disclosure timelines

IPOs & EXITS

M&A The Highest On Record For Unicorn Exits In 2025 (Crunchbase, 3 minute read)

Unicorn exits rebounded sharply in 2025 after three slow years, with both IPOs and M&A returning to near pre-2021 levels. M&A hit a record, with 36 unicorn acquisitions totaling $67B, led by Google’s $32B purchase of Wiz, alongside deals for Dunamu ($10.3B), Chronosphere ($3.4B), Celestial AI ($3.3B), and Moveworks ($2.9B). IPO activity also improved, with 40 unicorns listing via traditional IPOs (plus two via SPACs), for a combined $207B in listing value, in line with 2018–2019 levels, major debuts included CoreWeave, Figma, Klarna, Chime, and Mixue Group

Despite the pickup, the unicorn overhang remains large, with the Crunchbase Unicorn Board nearing $7 trillion in value across about 1,640 companies, many minted during the 2021–2022 peak

This backlog keeps pressure on exits and is fueling expectations that a broader IPO rebound could arrive in 2026

Trump Media is merging with fusion power company TAE Technologies in $6B+ deal (TechCrunch, 3 minute read)

Trump Media & Technology Group (TMTG) announced a $6+ billion all-stock merger with fusion startup TAE Technologies, marking an unusual expansion from social media into energy as AI-driven data centers fuel rising electricity demand. TMTG, which went public via SPAC and reported a $54.8 million loss on $972,900 in revenue in Q3 2025, says the deal would support plans to build a 50-MW utility-scale fusion plant next year, with future facilities targeting 350–500 MW each

TAE, founded in the late 1990s, has raised nearly $2 billion and is valued at about $1.8 billion

Commercial fusion remains unproven, with only one experiment worldwide achieving net energy gain

Industry observers question execution risks and potential conflicts of interest as the Energy Department considers future fusion funding, highlighting the deal’s ambition and uncertainty

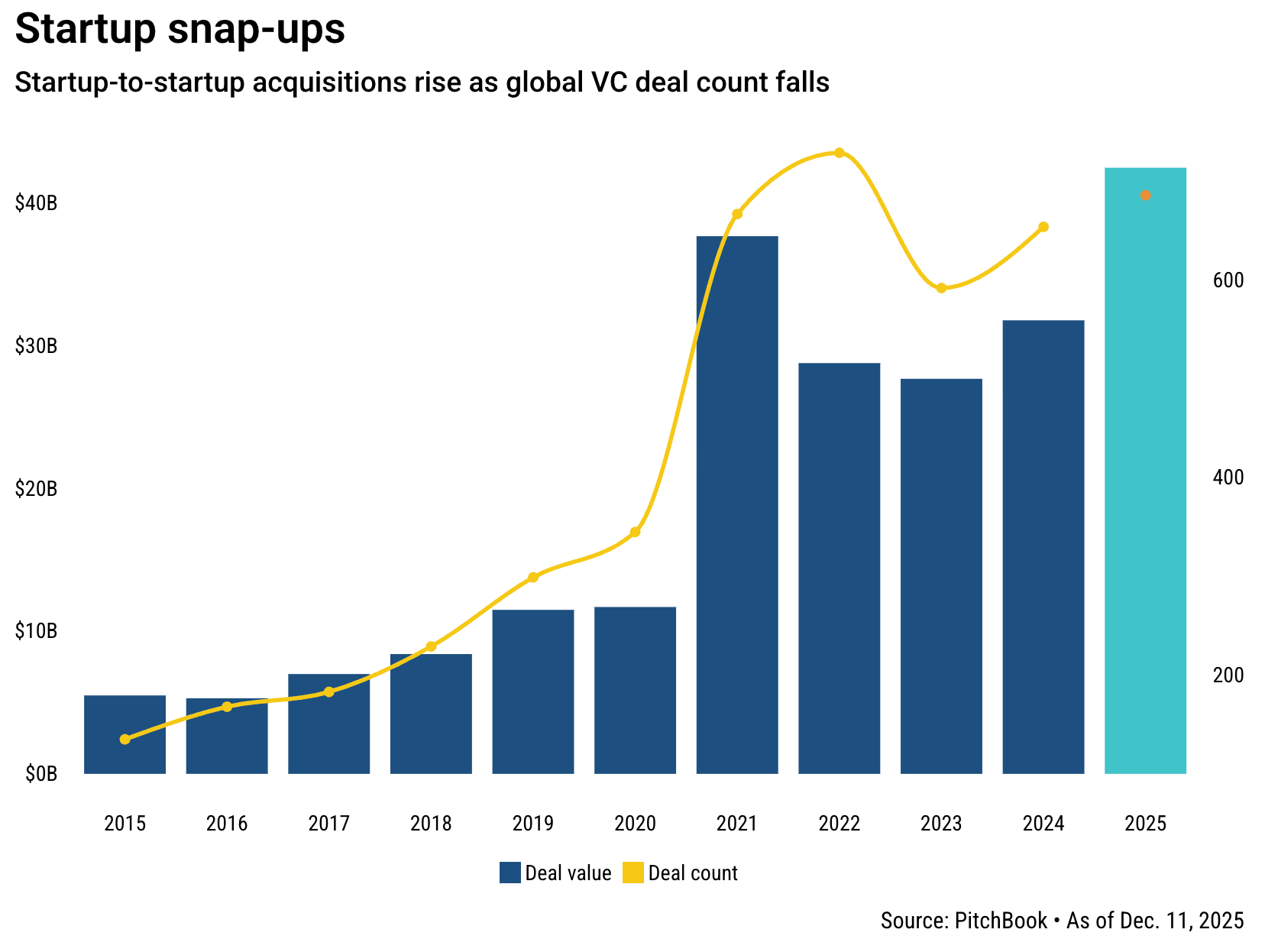

With VC dealmaking down, startup buyers are filling the gap (PitchBook, 4 minute read)

As VC funding concentrates around top performers, startups are increasingly turning to M&A to survive and scale. PitchBook data shows startup-led acquisitions surged to 686 deals worth $42.5 billion in 2025, up 5% by count and 34% by value from 2024, with startups now accounting for nearly one-third of all VC M&A deals and 24.4% of total deal value, the highest share in a decade. While overall VC funding rebounded 35% year over year, deal counts remain 15% lower, pushing capital toward fewer winners and making consolidation an attractive alternative for companies struggling to raise

VCs are encouraging portfolio companies to pursue peer acquisitions, a trend amplified in AI where intense competition has driven more acqui-hires

High-profile examples include OpenAI’s $6.5 billion acquisition of io Products and its $1.1 billion purchase of Statsig

WHAT A TIME TO BE ALIVE

Cleantech’s Rough Year Ends On An Up Note (Crunchbase, 5 minute read)

Despite strong macro tailwinds, 2025 was a weak year for cleantech startup funding. Global clean energy investment is on track to reach $2.2 trillion, double fossil fuel spending, while venture funding topped $300 billion in the first three quarters and climate pressures intensified as greenhouse gas levels and global temperatures hit records. Yet startups in cleantech, EVs, and sustainability raised just $24 billion across all stages, the lowest total in five years

Deal activity slowed early as investors adjusted to policy changes, then rebounded later in the year, led by nuclear, geothermal, energy storage, and electric aviation

The biggest rounds went to Base Power ($1.2B), Commonwealth Fusion ($863M), X-energy ($700M), and TerraPower ($650M), while battery investment stayed cautious after Northvolt’s collapse

Encouragingly, funding momentum improved toward year-end, suggesting a firmer setup for cleantech investment ahead as demand drivers continue to strengthen

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team