- AlphaInsights by 8alpha.ai

- Posts

- The TACO Index

The TACO Index

Week of October 13th, 2025

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Polymarket And Reflection AI Lead A Varied Lineup Of Megarounds (Crunchbase, 5 min read)

Polymarket (Prediction Market): Intercontinental Exchange, operator of the NYSE, will invest up to $2 billion in the New York-based prediction market platform, valuing it at $8 billion pre-money. Polymarket lets users wager on event probabilities across politics, markets, sports, and more

Reflection AI (AI): New York-based Reflection AI raised $2 billion in a round backed by Nvidia and leading VCs, reaching an $8 billion valuation, a 15x increase in just seven months. The company develops open-standard LLM training models for large-scale AI development

Base Power (Battery Power): Austin-based Base Power secured $1 billion in Series C funding led by Addition to expand its battery-powered home energy systems. Founded in 2023, the company has now raised $1.3 billion in total

Stoke Space (Space Tech): Stoke Space raised $510 million in Series D funding led by the US Innovative Technology Fund, alongside a $100 million debt facility from Silicon Valley Bank. The funding will expand production of its reusable launch vehicles and activate its Cape Canaveral launch complex

Expedition Therapeutics (Biotech): San Francisco-based Expedition Therapeutics raised $165 million in Series A funding co-led by Sofinnova Investments and Novo Holdings. The biotech is developing therapies for inflammatory and respiratory diseases, with funds supporting Phase 2 trials for its lead COPD treatment

North American Startup Funding Held High In Q3 (PitchBook, 2 min read)

North American startup funding remained strong in Q3 2025, driven by investors’ continued appetite for AI. Total investment reached $63.1 billion across US and Canadian startups, up slightly from Q2 and more than $20 billion higher year over year. The gains came from larger rounds rather than more deals, with 2,276 total rounds, slightly down from the previous quarter. AI dominated the landscape, capturing 57% of all funding, led by Anthropic’s $13 billion Series F, which alone represented over one-fifth of all startup capital

Late-stage rounds accounted for $42.9 billion, including billion-dollar raises by Cerebras, Figure, and PsiQuantum, while early-stage deals climbed to $15.6 billion

Seed funding dropped to $4.6 billion following Q2’s record-breaking period

AI investment totaled $35.7 billion, nearly double year-ago levels, and exit activity remained steady, highlighted by Figma’s blockbuster IPO and notable M&A moves from Atlassian and OpenAI

California becomes first state to regulate AI companion chatbots (TechCrunch, 3 min read)

California has become the first state to regulate AI companion chatbots, as Governor Gavin Newsom signed SB 243 into law, requiring companies like OpenAI, Meta, Character AI, and Replika to implement safety protocols to protect children and vulnerable users. Prompted by tragic cases involving minors and harmful chatbot interactions, the law, effective January 1, 2026, mandates age verification, crisis intervention systems, clear AI disclaimers, and restrictions on explicit or manipulative content

It also imposes fines of up to $250,000 for illegal deepfakes

Newsom said the goal is to ensure innovation “with responsibility,” emphasizing child safety and accountability in emerging AI technologies

The bill follows SB 53, which introduced new transparency and whistleblower protections for large AI labs

Nvidia reportedly adds xAI to its growing AI venture portfolio as part of $20B round (PitchBook, 2 min read)

Nvidia is reportedly investing $2 billion in equity as part of Elon Musk’s xAI’s $20 billion fundraising round, which combines $7.5 billion in equity and $12.5 billion in debt. The round, structured through a special-purpose vehicle (SPV), will fund the purchase of Nvidia GPUs for xAI’s Memphis data center, Colossus 2, with the chips serving as collateral and rented out to offset investor costs

The move expands Nvidia’s growing influence across the AI ecosystem, where it already backs OpenAI, Perplexity, Cohere, Crusoe, Lambda, and Poolside

It also follows a $100 billion chip partnership with OpenAI and a $900 million acqui-hire of semiconductor startup Enfabrica

The investment underscores Nvidia’s strategy to own the infrastructure powering the global AI boom

ECONOMIC SNAPSHOT

China warns US of retaliation over Trump’s 100% tariffs threat (The Guardian, 3 mins read)

Beijing has warned it will retaliate if Donald Trump follows through on his threat to impose 100% tariffs on Chinese imports starting November 1. China’s commerce ministry accused Washington of raising tensions, saying it “does not want a trade war, but is not afraid of it.” The tariffs, paired with new US export controls on critical software, were announced after Beijing restricted shipments of rare-earth minerals vital to US industries

The standoff triggered heavy market losses, wiping nearly $2 trillion off US stocks on Friday and pushing the Dow down 1.9%

While Trump later struck a softer tone, hinting at possible talks with President Xi, investors remain wary

Analysts view Trump’s move as another “escalate-to-de-escalate” tactic aimed at forcing concessions, though Beijing insists its export controls are lawful and limited to civil-use cases

Markets rebound amid latest US-China tariff spat as traders look to possible ‘Taco trade’ (The Guardian, 3 min read)

Global markets edged higher and cryptocurrencies rebounded after easing fears that the escalating US-China trade dispute could spiral further. Tensions rose as President Trump threatened 100% tariffs on Chinese goods over rare-earth export restrictions, prompting warnings of retaliation from Beijing. However, Trump’s conciliatory comments over the weekend, suggesting a potential deal and goodwill toward China, calmed investors

The S&P 500 gained 1.1%, the Nasdaq rose 1.7%, and major European indexes saw modest upticks, while Bitcoin rebounded above $115,000 and Ether climbed to $4,100 after steep weekend losses

Still, uncertainty kept gold at record highs above $4,000 an ounce, reflecting ongoing caution

In Asia, sentiment remained fragile, with Hong Kong’s Hang Seng down 1.5%, though Chinese exports surged 8.3% year-over-year in September, signaling resilience amid trade turbulence

US economy growing at fastest pace in nearly 2 years — and the White House has declared it ‘explosive growth’ (Yahoo Finance, 6 min read)

The US economy is sending mixed signals, leaving analysts split on whether it’s rebounding or weakening. The White House hailed a revised Q2 GDP growth of 3.8%, up from 3.3%, as proof of “explosive growth,” driven by higher consumer spending and fewer imports. Yet other indicators paint a gloomier picture: job losses, rising unemployment at 4.3%, and tariffs and inflation weighing on households. Analysts note that spending is concentrated among the top 10% of earners, while most Americans are merely keeping pace with inflation

Excluding tech and software investment, GDP growth would be just 0.1%, according to Harvard economist Jason Furman

Economists warn that momentum may slow in the second half of 2025 as policy uncertainty and debt pressures mount, with Yale’s Budget Lab projecting long-term drag from Trump’s fiscal policies

Public sentiment mirrors the unease, 67% of Americans say the economy is on the wrong track, and most blame rising prices and shrinking purchasing power

IPOs & EXITS

India’s Tata Capital makes muted market debut after $1.75 billion IPO (CNBC, 3 min read)

Tata Capital shares rose 1.37% in their trading debut on the National Stock Exchange and BSE after raising ₹155.1 billion ($1.75 billion) in one of India’s largest IPOs of 2025. Priced at ₹326 per share, the offering was fully subscribed, attracting strong institutional demand at 3.4 times the allocation and moderate interest from retail investors

Despite a solid debut, analysts called the performance muted amid weak sentiment toward nonbank lenders, India’s slowdown, job worries, and US tariff pressures

Tata Capital, the country’s third-largest nonbank lender, provides retail, SME, and infrastructure financing

The listing comes as India’s IPO market surges, with 146 IPOs raising $7.2 billion in Q3 2025 and 254 IPOs totaling $11.8 billion year-to-date, underscoring the country’s growing capital market depth

Cerebras Systems Pulls Plug On Its IPO Days After Big Fundraise (Crunchbase, 2 min read)

Cerebras Systems, the Sunnyvale-based AI chipmaker, has withdrawn its planned IPO just days after securing $1.1 billion in Series G funding at an $8.1 billion valuation led by Fidelity and Atreides Management. The company, founded in 2016 and backed by Sequoia, Coatue, and Benchmark, had filed to go public in 2024 as a rival to Nvidia but cited that its previous prospectus was now “out of date”

Cerebras has since shifted from selling hardware to offering cloud-based AI compute services

Its reliance on Group 42, which accounted for over 80% of 2023–2024 revenue, remains a key risk factor

With $1.8 billion raised to date, Cerebras continues to position its AI processors, reportedly 10x faster than leading GPUs, for customers like Mistral AI and the Mayo Clinic

StubHub gains ground after analysts endorsements ease post-IPO jitters (Reuters, 3 min read)

StubHub shares climbed nearly 6% on Monday after multiple brokerages issued bullish ratings following the end of the company’s IPO quiet period. Analysts from J.P. Morgan, BofA Global Research, Evercore ISI, and BMO Capital Markets praised StubHub’s dominance in secondary ticketing and growing push into primary ticketing and advertising, with price targets ranging from $24 to $30. Despite trading at $20 per share, below its $23.50 IPO price, analysts see strong risk/reward potential and expect steady execution in resale and ads

StubHub raised $800 million in its US IPO to help pay down $2.4 billion in debt, marking its return to public markets after delays since its $4.05 billion acquisition by Viagogo in 2020

Founded in 2000, StubHub operates across 200+ countries, offering tickets for sports, music, and live events, and is viewed as both a market leader and disruptor in global ticketing

WHAT A TIME TO BE ALIVE

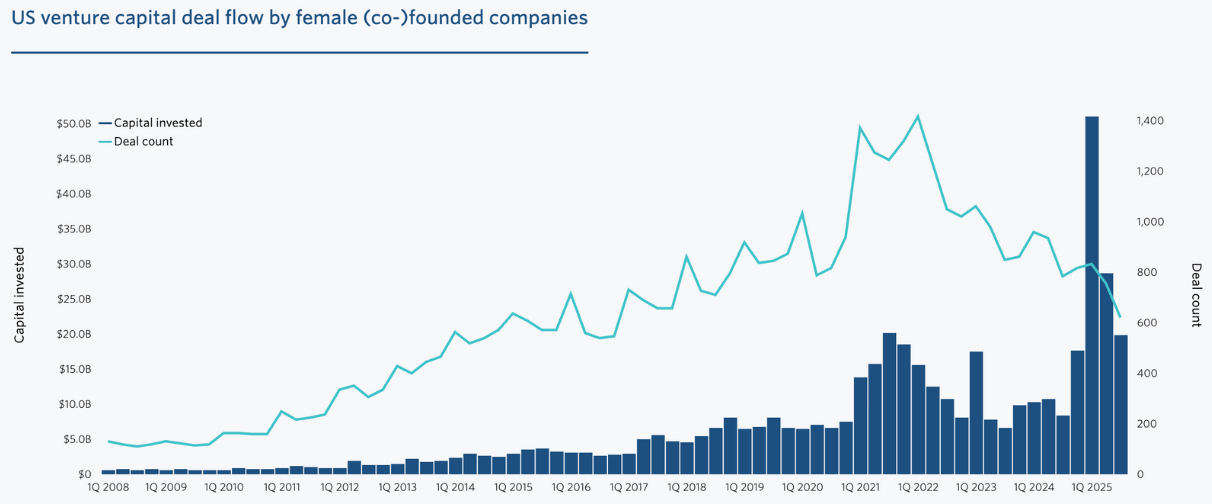

US VC female founders dashboard (PitchBook, 5 min read)

Venture capital funding for female-founded startups in the US has stabilized after a steep decline from the 2021 peak. While women-led companies now represent a smaller share of total VC deals, they continue to capture a growing portion of total capital raised, signaling stronger deal quality and investor confidence. In Q3 2025, women co-led companies secured $19.8 billion across 621 deals, down from $28.6 billion and 754 deals in Q2

So far in 2025, female-only founded companies have captured 5.8% of total deal count, while female-and-male co-led teams account for 17.5%

In terms of capital, female-only teams received 0.9% of total VC investment, compared to 41.4% going to mixed-gender founding teams

According to PitchBook data, the 16-year trend shows steady progress across states, industries, and stages, highlighting a sustained shift toward greater inclusion and visibility for women founders in the US venture ecosystem

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team