- AlphaInsights by 8alpha.ai

- Posts

- The Money Map of 2025

The Money Map of 2025

Week of December 29th, 2025

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

PitchBook Analyst Note: AI, Megadeals, and the Making of a Concentrated Venture Market (PitchBook, 5 minute read)

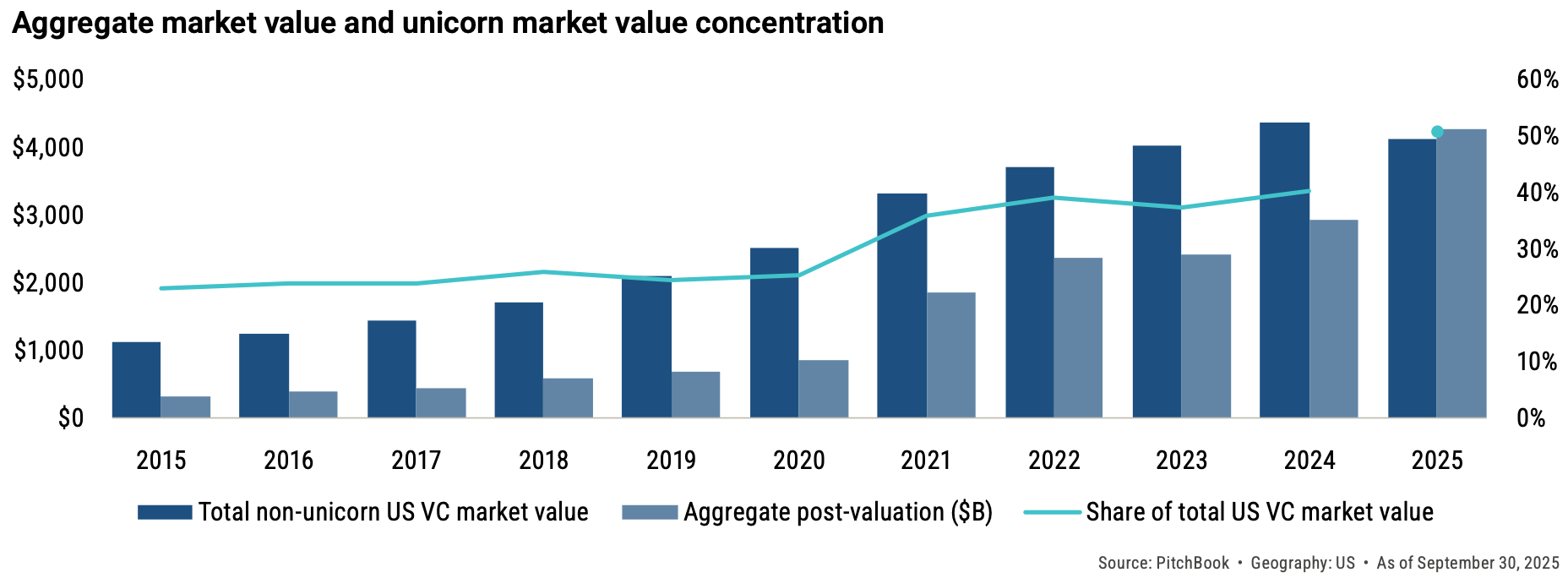

U.S. venture deal value rebounded sharply in 2025, reaching $250 billion through Q3, but activity has become far more concentrated than in prior years. The 10 largest deals accounted for 38.9% of total capital, with just four transactions totaling $77.5 billion, underscoring how a small number of mega-rounds are driving market totals. AI has been the main force behind this concentration, representing 65% of U.S. venture deal value, as leading model developers such as OpenAI, Anthropic, and xAI continued to raise multi-billion-dollar rounds

Megafunds ($500M+) now hold 58.7% of total dry powder, up from 39.9% a decade ago, while smaller funds account for only 16% despite being the most numerous by count

This dynamic has further tilted deal activity toward major hubs, with the Bay Area capturing 22% of deals in 2025 through Q3 and 50% of total U.S. venture commitments over the past decade

AI start-ups amass record $150bn funding cushion as bubble fears mount (Financial Times, 5 minute read)

Silicon Valley’s largest startups raised a record $150 billion in 2025, far exceeding the previous peak of $92 billion in 2021, as investors urged founders to build “fortress balance sheets” amid concerns the AI investment cycle could cool in 2026. Fundraising was heavily concentrated in a small group of AI leaders, led by OpenAI’s $41B round, with fast-growing companies like Anysphere and Perplexity returning to investors multiple times in a single year

The surge reflects both rapid growth and rising costs for frontier AI models, which require massive compute and infrastructure spending

Top startups are raising capital more frequently than the historical 2–3 year cycle, while funding has tightened for smaller firms

Investors say the strategy is to secure cash while markets are open, support continued expansion, and position leading companies to pursue acquisitions if sentiment shifts and weaker rivals struggle to raise capital

ECONOMIC SNAPSHOT

Strong GDP And Rising Profits Set Up A Resilient US Economy For 2026 (Forbes, 6 minute read)

U.S. stocks delivered strong gains in 2025 despite early volatility tied to tariff concerns, supported by easing trade pressures and continued momentum from AI-driven investment. Economic data reinforced that resilience: third-quarter GDP grew at a robust 4.3% annualized, led by stronger-than-expected consumer spending and net exports, while underlying private domestic demand rose 3%, its fastest pace since Q3 2024. Corporate profits increased 9.1% year over year, capital expenditures continued to rise, and inventories declined, setting up a potential growth tailwind into year-end

Markets are pricing in low recession risk, reflected in outperformance of cyclical and bank stocks and a 1.90% real yield on the 10-year Treasury

Growth momentum is expected to continue, supported by rising fiscal stimulus, a projected 44% increase in federal tax refunds, and expectations for up to two more Fed rate cuts after 1.75 percentage points of easing so far

Consensus forecasts point to 15% S&P 500 earnings growth in 2026, led by a 28.6% rise in tech profits, while valuations remain high at roughly 22.3× forward earnings, keeping markets sensitive to labor and policy shifts

US GDP Growth Components

The 2025 US economy – in charts: rising prices, hiring slowdown, rollercoaster growth (The Guardian, 6 minute read)

Inflation and the labor market were the main points of tension in the US economy in 2025. Inflation eased from its 2022 peak but remained elevated, with the Fed’s preferred personal consumption expenditures (PCE) index rising to 2.8% in the third quarter, up from 2.1% in the prior quarter, suggesting renewed price pressures. Economists have warned that broad tariffs on imports could add to costs, particularly for lower- and middle-income households, even as higher-income consumers continue to spend. At the same time, labor conditions weakened

Job growth cooled after the post-pandemic rebound, with job losses in June, August, and about 105,000 jobs shed in October during the shutdown, followed by a 64,000 gain in November

The unemployment rate rose to 4.6% in November from about 3.7% a year earlier, and the number of unemployed Americans increased by roughly 1 million

Real income growth stalled for many households, and pandemic-era savings have largely been depleted, raising the risk that higher prices and weaker job trends could slow consumer spending in 2026

IPOs & EXITS

Crunchbase Predicts: IPOs Picked Up In 2025 And The Outlook For 2026 Is Even More Optimistic (Crunchbase, 5 minute read)

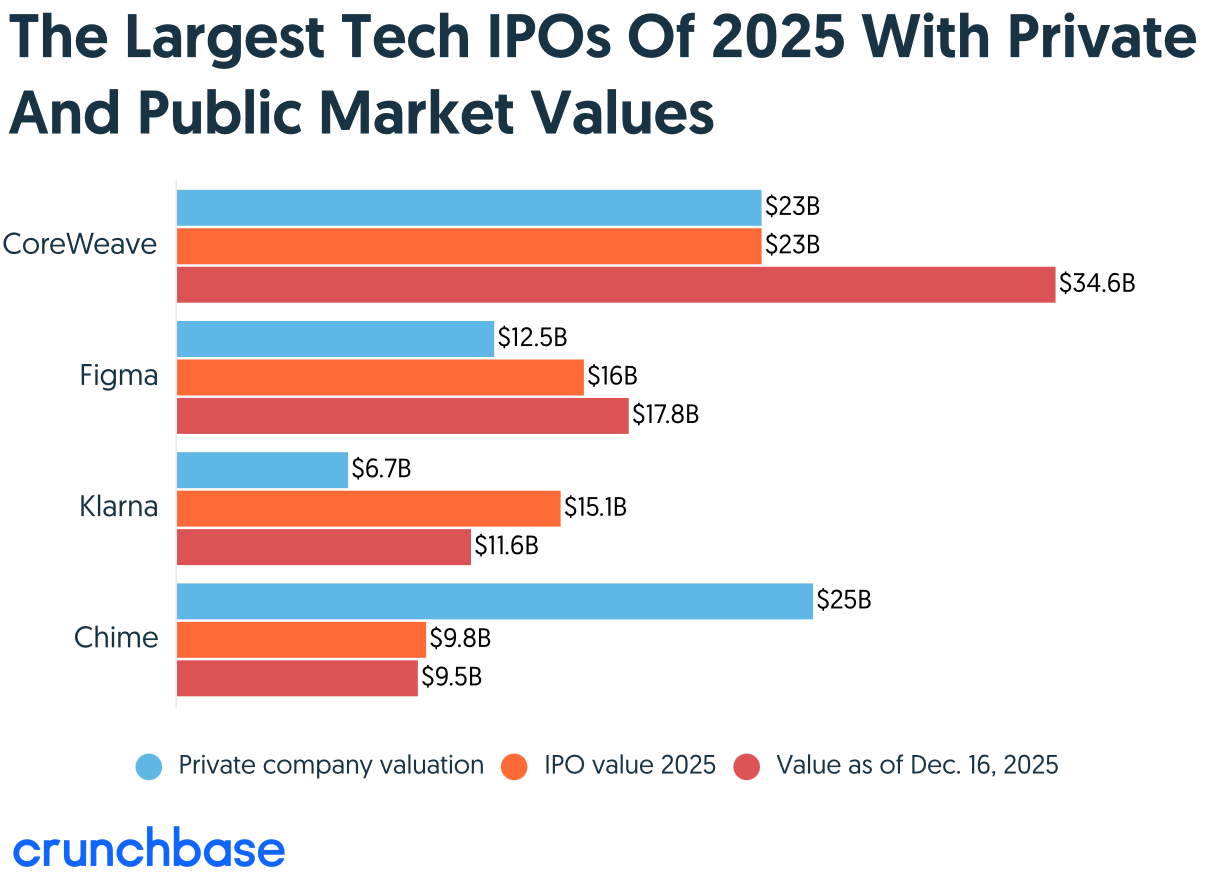

The U.S. tech IPO market strengthened in 2025, with at least 23 companies listing at valuations above $1 billion, up from nine in 2024, and total IPO valuations reaching about $125 billion, more than doubling year over year. High-profile debuts included CoreWeave, Figma, Chime, and Klarna, with CoreWeave’s shares up 60%+ from its listing price as of mid-December

Activity slowed during the government shutdown, but advisers expect a busier Q1 and improving momentum into 2026, especially if interest rates decline

Biotech and healthcare led billion-dollar listings (six companies), followed by crypto and blockchain (four), fintech (three), and insurance and aerospace (two each), with crypto-related IPOs among the stronger performers

While activity is still below pre-2021 highs, expectations are growing for larger IPOs in late 2026 as valuations stabilize and companies look for public-market liquidity

This Year’s IPO Billionaires See Wealth Eroded by Market Moves (Bloomberg, 6 minute read)

The IPO rebound in 2025 minted 21 new paper billionaires, but post-listing performance has often been uneven. Bloomberg data shows that insiders whose stakes exceeded $1 billion on IPO day have seen the value of those holdings decline by an average of 23% in the following weeks or months, reflecting how momentum-driven many debuts were. Several high-profile IPOs experienced sharp reversals after first-day or first-week surges, with some stocks falling 50%–70% or more from peak levels as earnings disappointed, lockups approached, or sector sentiment cooled

A smaller group of listings, including CoreWeave, Circle, Figure, and Neptune Insurance, have held closer to or above their offering prices, helped by clearer revenue growth, regulatory tailwinds, or sustained investor demand

Overall, the 2025 IPO class underscores both the return of risk appetite and a familiar dynamic: headline-grabbing debuts can create substantial paper wealth, but longer-term outcomes remain highly sensitive to fundamentals, market conditions, and execution after going public

Global dealmaking hits $4.5tn in second-best year on record (Financial Times, 4 minute read)

Global M&A rebounded sharply in 2025, with dealmaking reaching $4.5 trillion, up nearly 50% from 2024 and the second-highest total in more than 40 years, surpassed only by the 2021 boom. Activity was driven by a surge in megadeals, with 68 transactions valued at $10 billion or more, helping lift investment banking fees to about $135 billion, the second-highest level on record, up 9% year over year. The U.S. led the recovery, accounting for $2.3 trillion in deals, or more than half of global activity, the highest share since 1998, supported by strong equity markets, ample financing, and a more permissive regulatory environment

Momentum briefly slowed after sweeping tariffs announced in April, but rebounded quickly, with back-to-back quarters exceeding $1 trillion in M&A for the first time in four years

Despite the headline growth, dealmaking became more polarized: the number of transactions fell 7%, the lowest since 2016, reflecting fewer small and mid-sized deals

Private equity lagged the broader market, with deal value rising just over 25% to $889 billion, though several large take-private transactions stood out, including a $55 billion deal for Electronic Arts

A Year Of Quiet Progress: How Tariffs And AI Shaped M&A In 2025 And What To Expect In The Year Ahead (Forbes, 4 minute read)

2025 marked a year of cautious but measurable progress for global M&A, as dealmakers adjusted to tariff shocks, shifting trade policies affecting 60+ countries, and ongoing macro uncertainty around rates, geopolitics, and regulation. Rather than broad consolidation, activity tilted toward targeted, often domestic acquisitions, with large-cap transactions in technology, telecom, financial services, industrials, and renewable energy driving results. While overall deal volume declined, total deal values increased, reflecting a focus on fewer but larger and more strategic transactions

AI emerged as the key structural driver of M&A. Buyers increasingly competed for companies with established AI infrastructure, proprietary datasets, and machine-learning talent, supporting higher valuations and faster execution

Internal deal-flow data points to improving momentum: global deal volume rose 11% year over year in Q3 2025, roughly 43% of initiated deals reached close, and median diligence time improved to ~160 days

Heading into 2026, these indicators suggest selective but strengthening M&A activity, with AI shifting from an efficiency tool to an essential component of competitive dealmaking

WHAT A TIME TO BE ALIVE

Betting on climate failure, these investors could earn billions (Politico, 7 minute read)

Solar geoengineering, technologies designed to reflect a small portion of sunlight to reduce global warming, remains a niche but increasingly visible corner of climate tech. To date, more than 50 investors, firms, and government agencies have committed roughly $115.8 million to nine startups developing sunlight-limiting approaches. Capital is highly concentrated: about $75 million (~65%) has gone to Stardust Solutions, which is developing reflective particles intended for deployment in the stratosphere (~11 miles above Earth)

At least three other startups in the space have raised $5 million or more, while newer entrants are exploring both atmospheric and space-based concepts

However, funding levels are pale in comparison to AI and energy transition spending: OpenAI alone raised ~$62.5 billion in 2025

Overall, the landscape reflects growing curiosity and experimentation, tempered by scientific uncertainty, political sensitivity, and unresolved questions about risk, governance, and long-term viability

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team