- AlphaInsights by 8alpha.ai

- Posts

- Soft Jobs, Softer Fed?

Soft Jobs, Softer Fed?

Week of September 8th, 2025

Welcome to 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Anthropic Leads A Busy Week For Big Deals (Crunchbase, 5 minute read)

Anthropic (Generative AI): Raised $13 billion (Series F) at a $183 billion valuation, led by Iconiq Capital with Fidelity and Lightspeed co-leading. Anthropic is now the fourth-most valuable private company in the world

Sierra (Enterprise AI): Secured $350 million at a $10 billion valuation. Founded in 2023 by Bret Taylor (former Salesforce co-CEO, OpenAI board chair) and Clay Bavor (ex-Google), the company develops AI-driven customer experience platforms

Treeline Biosciences (Biotech): Closed a $200 million Series A extension, bringing total funding to $1.1 billion. The 4-year-old firm develops cancer and serious disease medicines and is preparing to begin multiple drug trials

Enveda Biosciences (Drug Discovery): Raised $150 million (Series D) led by Premji Invest, reaching unicorn status. The 6-year-old startup focuses on discovering new drugs from plant chemistry

Baseten (AI Tools): Raised $150 million (Series D) led by Bond, bringing total funding to $285 million. Baseten provides infrastructure for AI application developers

Google’s Big Day In Court Wasn’t That Big (Crunchbase, 4 minute read)

Judge Amit Mehta’s ruling in the U.S. government’s long-running antitrust case against Google was widely described as a “historic blow,” but in practice it left the company largely intact. The Justice Department had accused Google of abusing its dominance in search to block rivals and maintain market share, pushing for structural remedies such as selling Chrome. Instead, the court required Google to share some data with competitors, while Chrome, Android, and its default search deals remain untouched

Google has vowed to appeal, a process expected to take years and potentially reach the Supreme Court

That delay allows Google to continue operating as usual, giving it time to adapt and potentially turn compliance into a competitive advantage

The ruling also sends signals to the broader tech sector: if the main consequence of antitrust enforcement is limited data-sharing rather than breakups, firms like Apple, Amazon, and Meta may feel emboldened to take similar risks

Anthropic Nearly Triples Valuation To $183B With Massive New Funding (Crunchbase, 2 minute read)

San Francisco-based generative AI firm Anthropic raised a $13 billion Series F at a $183 billion valuation, led by Iconiq Capital, with Fidelity and Lightspeed co-leading. This nearly triples its March 2025 valuation of $61.5 billion and makes Anthropic the fourth-most valuable private company globally, behind OpenAI among AI peers. The round lifts Anthropic’s total funding to $33.7 billion since its 2021 founding

The startup reports a $5 billion revenue run rate as of August, up from $1 billion earlier this year, driven by rapid enterprise adoption with 300,000+ business customers

The deal highlights how AI continues to dominate venture capital, with $40 billion raised in Q2 alone, accounting for 45% of global funding

Anthropic’s raise underscores the trend of larger, late-stage rounds concentrating capital into a handful of leading AI players

Where’s Venture Capital Going? The AI Gold Rush, Of Course (Visual Capitalist, 2 minute read)

AI firms are capturing an unprecedented share of venture capital, accounting for 71% of equity investments in Q1 2025, up sharply from 45% in 2024 and just 14% in 2020. In the last decade, U.S. private investment in AI has totaled $471 billion, the highest globally. Foundational model makers such as OpenAI and Anthropic received the bulk of capital, with OpenAI securing a record $40 billion megadeal in 2024

Anthropic raised $3.5 billion, while infrastructure providers like CoreWeave brought in $10 billion

More than three dozen AI startups have raised over $100 million each in 2025, underscoring investor enthusiasm and positioning AI as the central driver of U.S. venture markets

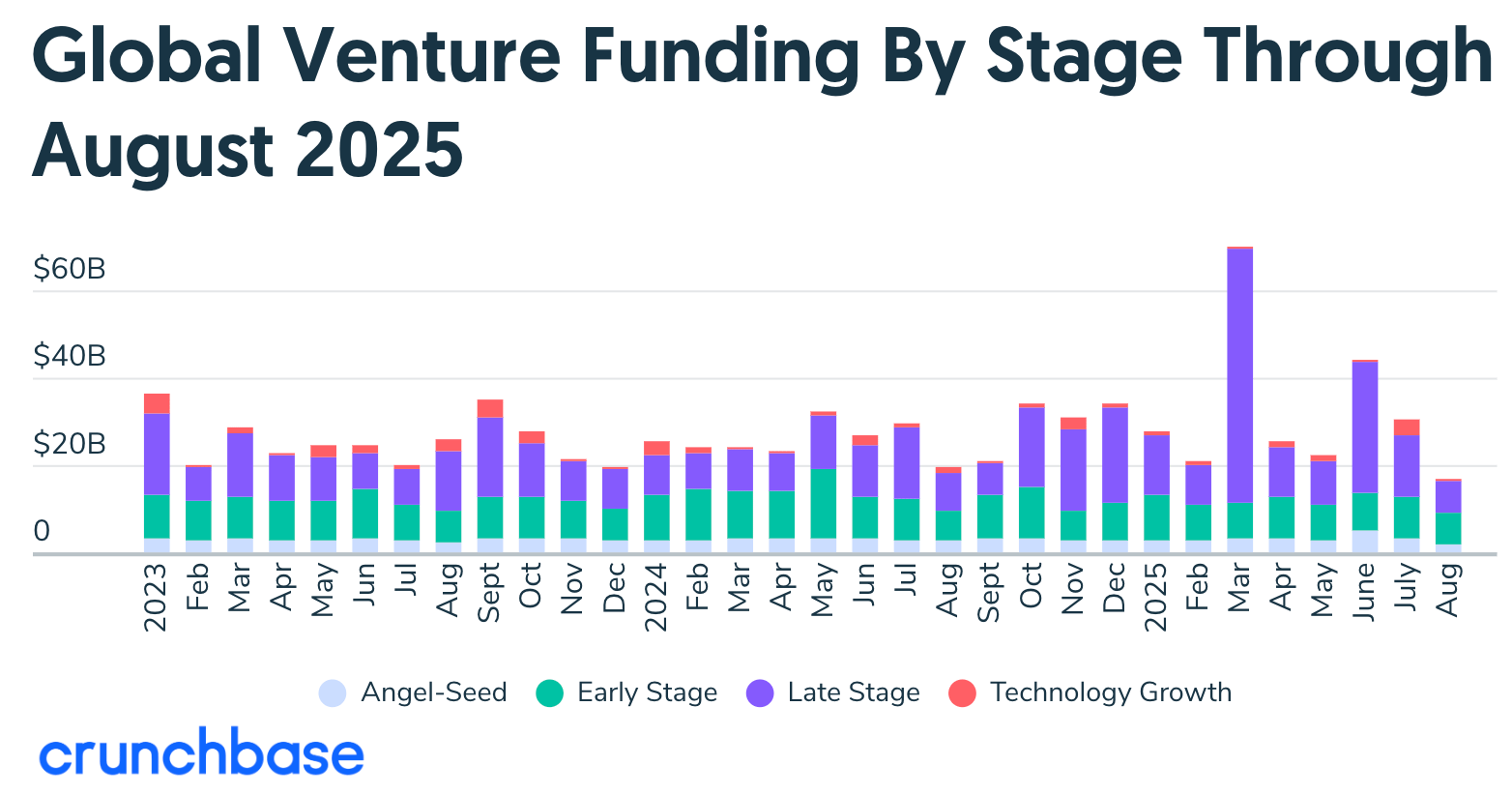

Global Startup Funding In August Fell To Lowest Monthly Total In 8 Years As Seed And Late-Stage Investors Retreated (Crunchbase, 3 minute read)

Global startup funding totaled $17 billion in August 2025, the lowest monthly amount since 2017. That’s down 44% from July and 12% year over year, marking a sharp slowdown after a strong first half of the year. The pullback hit all stages: late-stage funding fell more than 50% month over month, while seed-stage funding nearly halved from July. Early-stage deals declined slightly but remained above 2024 levels, with Series B rounds showing relative resilience

Major deals included Commonwealth Fusion’s $863 million Series B, Quantinuum’s $594 million Series B, and $500 million raises by Cohere (Series D) and Cognition (Series C)

The U.S. led global activity, with $10.4 billion (61%) of total funding, boosted by AI companies that attracted $4.8 billion

Healthcare and biotech followed with $4 billion, while financial services and energy each saw over $2 billion

ECONOMIC SNAPSHOT

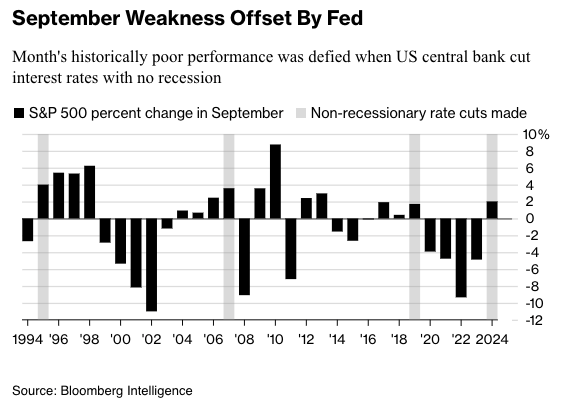

Stock Market’s Worst Month Historically May Be Rescued by Fed (Bloomberg, 3 minute read)

September is historically the weakest month for U.S. equities, with the S&P 500 falling an average 0.7–1% since 1971. However, history shows that when the Federal Reserve cuts rates in non-recessionary periods, September often delivers positive returns. This year, markets widely expect the Fed to lower rates on Sept. 17, following slowing job growth and rising unemployment. While this could buoy equities, risks remain: tariffs may pressure corporate profits, inflation is still above target, and market concentration in a few AI-driven tech giants heightens volatility

Analysts note that extreme downturns in past Septembers, such as 2008 (-9.1%) and 2001 (-8.2%), skew the averages

Absent such shocks, returns have been closer to flat or slightly positive, suggesting that bearish expectations based on seasonality alone may be overstated

What the latest jobs report means for you … buckle up (CNN, 5 minute read)

The U.S. economy added 22,000 jobs in August, while the unemployment rate rose to 4.3%, the highest in nearly four years. Recent revisions show that June recorded a net job loss, and the three-month average of job growth is now the weakest since 2010 outside the pandemic. A diffusion index measuring employment breadth shows more industries losing jobs than gaining them, with manufacturing and other goods-producing sectors hit hardest by tariffs and policy uncertainty

Health care remains the primary driver of job creation, adding nearly 47,000 positions in August, but it represents only 15% of total employment

Looking ahead, economists caution that rising unemployment could fuel a negative cycle of weaker spending and hiring

However, some analysts expect conditions to improve later this year if interest rate cuts, tax measures, and business investment incentives bolster demand for labor

China’s shipments to U.S. plunge 33% in August as overall exports growth hits a 6-month low (CNBC, 3 minute read)

China’s exports to the U.S. dropped 33% in August, contributing to the country’s weakest export growth in six months at 4.4% year-over-year, below expectations. Imports from the U.S. also declined 16%, reflecting the impact of U.S. tariffs, tighter scrutiny on transshipments, and waning benefits from earlier frontloading. Domestically, demand remains sluggish, with deflationary pressures persisting and producer prices down 2.9% year-over-year in August

While shipments to the U.S. fell 15.5% year-to-date, exports to the EU (+7.7%), ASEAN (+14.6%), Africa (+24.6%), and Latin America (+6%) surged as Chinese firms pursued diversification

Still, the U.S. remains China’s largest single-country market, absorbing $283 billion in goods this year versus $541 billion to the EU bloc

Economists expect the People’s Bank of China to cut rates to offset weak growth, while Beijing weighs additional fiscal support amid strained consumer stimulus programs

The US factory spending $100,000 a month more due to tariffs (BBC, 4 minute read)

President Trump’s sweeping tariffs, ranging from 10% to 50%, were introduced to spur a manufacturing revival and reduce reliance on foreign imports. However, recent data shows the impact has been mixed. Manufacturing payrolls declined by 12,000 jobs last month, and business surveys indicate that over 70% of manufacturers report higher costs and weaker profits due to tariff-driven increases in imported materials

While tariffs were intended to bring production back to the U.S., many firms face challenges such as labor shortages, rising input costs, and delayed investment plans

Economists note that while tariffs may protect certain industries in the short term, their broader effects have included higher consumer prices, reduced competitiveness, and uncertain long-term benefits for U.S. manufacturing

Supporters argue the policy needs more time to show results, but experts remain cautious about its ability to deliver a sustained industrial resurgence

IPO & EXITS

5 Companies Kick Off IPO Roadshow (Crunchbase, 3 minute read)

The U.S. IPO market is showing renewed momentum as five companies—Klarna, Figure, Gemini, Legence, and Black Rock Coffee Bar—kicked off their roadshows this week. Klarna, the Swedish fintech, is the most anticipated, targeting a $14 billion valuation with shares priced between $35–$37. Figure, a blockchain lender, is seeking up to $4.1 billion, while Gemini, the New York-based crypto exchange, aims for a $2.2 billion valuation

Engineering services firm Legence is targeting $2.95 billion, and Oregon-based Black Rock Coffee Bar plans to raise $265 million

The filings come after a slowdown earlier this year linked to U.S. tariff uncertainty

Klarna, founded in 2005, has raised $6.2 billion to date, backed by investors including Sequoia, General Atlantic, Silver Lake, and Santander

Navigating this post-Labor Day IPO wave (Pitchbook, 4 minute read)

The post-Labor Day window, historically favorable for IPOs, is seeing renewed activity with companies like Klarna, Gemini, and Via launching roadshows despite economic and political uncertainty. Recent IPOs have averaged 40–45% first-day gains, the highest since the dotcom bubble and the pandemic, driven by conservative pricing strategies to avoid weak market reactions. Experts caution that history shows such “IPO pops” don’t always translate to long-term returns

Data from Jay Ritter shows that investors in highly valued IPOs lost an average 49.5% over three years. Still, the trend continues as firms trade higher proceeds for morale-boosting opening-day jumps

Looking ahead, macroeconomic conditions and Federal Reserve signals will play a key role in sustaining momentum

Some predict that if massive IPO pops persist, venture-backed companies may explore direct listings to capture more value

Cybersecurity firm Netskope eyes up to $6.5 billion valuation in US IPO (Reuters / Yahoo Finance, 2 minute read)

Cloud cybersecurity firm Netskope has launched its U.S. IPO, seeking a valuation of up to $6.5 billion. The company plans to sell 47.8 million shares at $15–$17 each, raising as much as $813 million. Founded in 2012, Netskope develops cloud security software to protect apps, websites, and data. It competes with Palo Alto Networks and Zscaler in the secure access service edge market, which Gartner projects will expand from $7 billion in 2022 to $25 billion by 2027

The IPO, underwritten by Morgan Stanley and J.P. Morgan, comes as U.S. listings rebound after tariff-driven volatility

Netskope, last valued at $7.5 billion in 2021, will list on Nasdaq under the ticker NTSK

Rival Rubrik’s strong post-IPO performance has further fueled investor appetite for cybersecurity offerings

Klarna’s IPO will test if it’s more than just a one-trick ‘buy now, pay later’ pony (CNBC, 3 minute read)

Klarna is preparing for its long-awaited U.S. IPO at a valuation of up to $14 billion, down from its $45.6 billion peak in 2021 but above the $6.7 billion “down round” valuation of 2022. The Swedish fintech, best known for buy now, pay later (BNPL), is now pitching itself as a broader digital bank, rolling out deposit accounts, debit cards, and advertising services alongside merchant fees and financing

In Q2 2025, Klarna reported $823 million in revenue, up 20% year-over-year, though losses widened to $53 million

Comparisons with rivals like Affirm ($29B market cap, profitable) suggest Klarna’s growth prospects hinge on scaling efficiently while proving its neobank pivot is sustainable

While some project long-term revenues topping $10 billion with 20% margins, elevated interest rates and skepticism toward 0% financing models add uncertainty

Apple’s latest bid to get ahead in the AI race could require M&A (Pitchbook, 3 minute read)

Apple, long known for succeeding without being first to market, is now trailing in the AI era. While rivals like Google and Meta have made bold “acqui-hire” moves, Apple has taken a more cautious approach. Reports suggest it considered acquiring Perplexity (valued at $18 billion on $150 million in annualized revenue) and Mistral AI, but is instead working on its own AI-powered search tool, “World Knowledge Answers”

Analysts note Apple’s strategy reflects its historic M&A pattern of small, integration-focused bets rather than large, high-profile deals

This conservatism may slow its ability to compete, as generative AI rollouts often clash with Apple’s emphasis on privacy and user experience

Industry observers say that a well-timed acquisition could help close the gap, but with top AI companies commanding multi-billion-dollar valuations, it would require Apple to depart from its traditionally conservative acquisition playbook

WHAT A TIME TO BE ALIVE

US VC female founders dashboard (Pitchbook, 5 minute read)

Venture capital funding for female founders has stabilized following a sharp decline from 2021 peaks. While the share of total deals involving women-founded or co-founded companies has decreased, these companies are securing a growing proportion of the capital raised. A comprehensive dashboard tracks 16 years of U.S. investment trends for women founders, offering insights into deal counts, capital raised by state, industry, and stage, as well as highlighting notable female-founded startups and firms

So far Q3 2025, co-founded female companies reported $46 billion in capital invested and a total of 375 deals, compared to $8.4 billion in capital and 778 deals in Q3 2024

In terms of deal count, so far 2025, only female-led companies accounted for 5.9% of the total, while female and male-led companies together represented 17.6%

Regarding capital allocation, female-led companies received only 2.1%, whereas female and male-led companies collectively received 21.6%

Black unemployment jumps to 7.5% as August jobs report shows economic cooling (The Economic Times, 4 minute read)

The U.S. economy added just 22,000 jobs in August, pushing unemployment to 4.3%, the highest in nearly four years. Revisions showed June’s job gains turned into losses, marking the first negative reading since 2020. The downturn has disproportionately affected Black workers, whose unemployment rate rose to 7.5%, compared with 3.5% for white and Asian Americans and 5.3% for Hispanic Americans

Economists warn this reflects a recurring pattern in downturns where minority workers are hit hardest

The weak report has increased expectations of a Federal Reserve interest rate cut at its September meeting

Fed officials have signaled concern over labor market turbulence alongside tariff-driven inflation pressures, while the White House has defended its economic record and promised stronger job growth ahead

AI8 VENTURES HIGHLIGHT

The Illusion of Recovery - Venture Capital 2025

“We’re bringing wealth back to America. That’s a big thing... It takes a little time, but I think it should be great for us.”

We are living in a world defined by rapid and accelerating change, political, economic, social, and technological. This is not a typical business cycle. We are in an era shaped by powerful megatrends, with AI transforming industries, geopolitical shifts reshaping markets, and macroeconomic forces creating new uncertainties.

Just weeks before the 2024 election, The Economist described the U.S. economy as the “envy of the world.” After Donald Trump’s victory in November, markets initially anticipated controlled inflation, deregulation, and a less restrictive monetary policy. Fast-forward a few months to April 2025, and the optimism has faded. With capital markets reacting negatively to renewed trade war fears, over $5 trillion in market value were erased in a couple of days.

2025 opened with headlines proclaiming a venture capital comeback.

On paper, VC funding rebounded, driven by an unprecedented surge in AI investment. But beneath the surface, it’s a tale of two markets: one propelled by billion-dollar mega-deals in Artificial Intelligence, and another still struggling to regain traction amid macroeconomic uncertainty, investor hesitation, and a lingering liquidity crunch.

With Trump reigniting trade wars, tariffs reshaping global supply chains, and AI advancing at breakneck speed, it’s becoming harder than ever to place clear bets.

The real question is: what are you going to bet on?

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team