- AlphaInsights by 8alpha.ai

- Posts

- Silver and Gold Down. AI Up.

Silver and Gold Down. AI Up.

Week of February 2nd, 2026

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: AI Megadeals Dominate Again (Crunchbase, 5 minute read)

Ricursive Intelligence (AI): Frontier AI lab Ricursive Intelligence raised $300 million in a Series A round at a $4 billion valuation led by Lightspeed Venture Partners. The Palo Alto–based company closed the financing just two months after launching

Cellares (Biotech): Cell therapy manufacturing startup Cellares raised $257 million in a Series D round led by BlackRock and Eclipse. Founded in 2019, the South San Francisco–based company has raised $612 million to date to scale automated cell therapy production

Upwind Security (Cloud Security): Cloud security unicorn Upwind Security raised $250 million in Series B funding led by Bessemer Venture Partners. The San Francisco–headquartered company has now raised more than $430 million total

Decagon (AI Agents): AI customer service startup Decagon raised $250 million in new funding led by Coatue and Index Ventures, tripling its valuation to $4.5 billion in under six months. The San Francisco–based company is focused on deploying AI agents for enterprise support

PaleBlueDot AI (AI Compute): AI compute platform PaleBlueDot AI raised $150 million in a Series B round led by B Capital at a valuation of over $1 billion. Founded in 2024, the Palo Alto–based company is building infrastructure to support large-scale AI workloads

6 Trends In Tech And Startups We’re Watching In 2026, From An IPO Boom To More Huge AI Deals (Crunchbase, 4 minute read)

After a third-strongest year on record for global venture funding, behind only 2021 and 2022, the startup ecosystem is heading into 2026 with cautious optimism, supported by a rebound in IPOs, steady M&A, and renewed investor confidence. In 2025, 23 U.S. companies went public at $1 billion-plus valuations, up from nine the prior year, with combined IPO valuations reaching $125 billion, while roughly 2,300 venture-backed M&A deals closed. Investors expect venture funding to grow 10% to 25% in 2026, with most capital going to AI, robotics, and defense tech, alongside a fintech rebound that saw funding rise 27% year over year to $51.8 billion

However, capital concentration remains a growing concern, as just five AI companies raised $84 billion, or 20% of all venture funding, in 2025

2025 set multiple records, including the largest private funding round ($40 billion to OpenAI), the highest private valuation ($800 billion for SpaceX), and the largest venture-backed acquisition ($32 billion, Wiz by Google)

Meanwhile, AI-driven efficiency gains contributed to about 55,000 U.S. tech layoffs, highlighting growing concerns around job losses, capital concentration, and a potential AI bubble despite strong market momentum

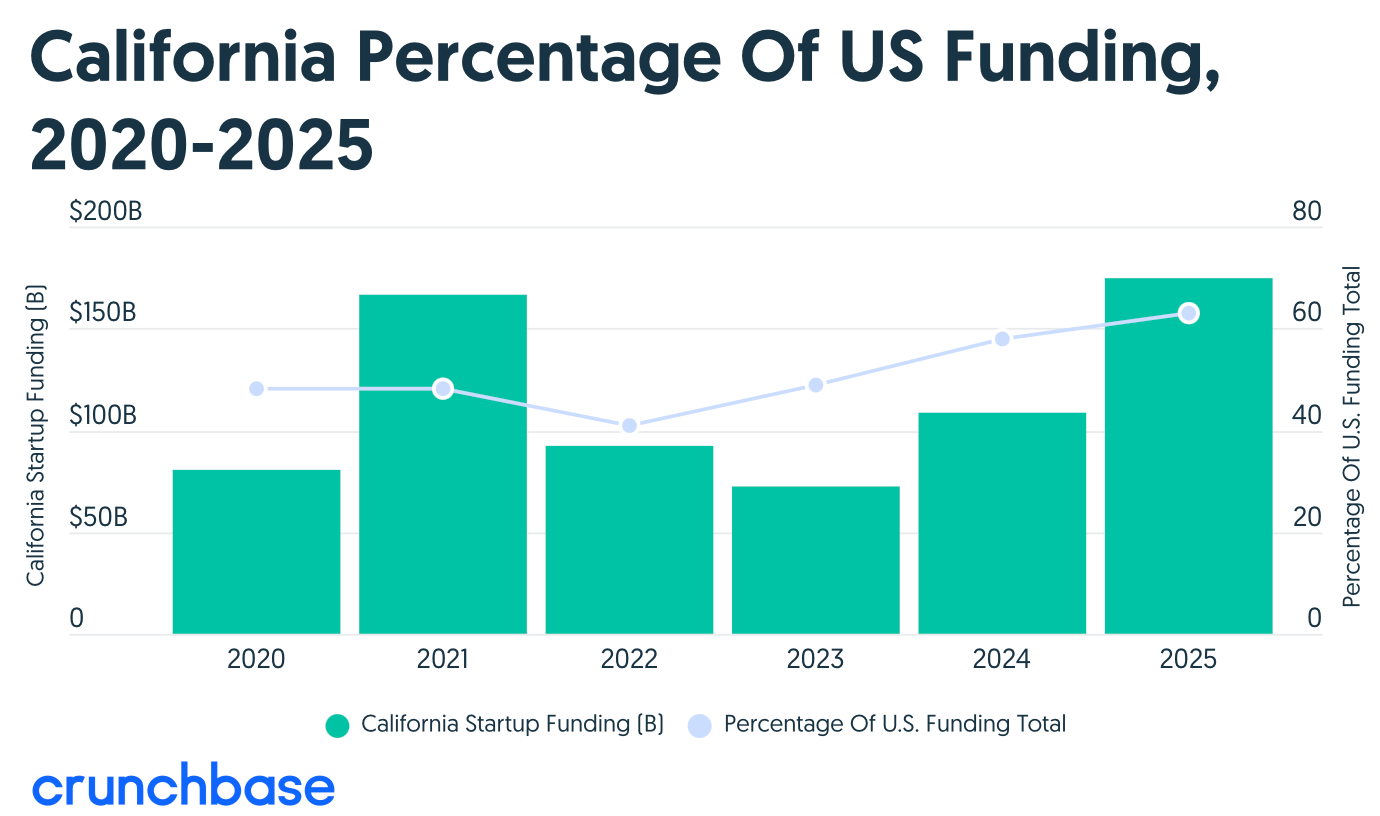

What’s Fueling California’s Record Run For Startup Funding? (Crunchbase, 3 minute read)

California’s dominance in the startup ecosystem is stronger than ever, with companies in the state capturing 63% of all U.S. startup funding last year, far ahead of New York (11%), Massachusetts (5%), and Texas (4%). That lead is even more pronounced in AI, where California-based startups accounted for 80% of seed-to-growth funding, fueled by massive rounds like OpenAI’s $40 billion raise

This leadership reflects long-term strengths, including deep talent pools, top universities and labs, abundant capital, and a culture that tolerates high risk and failure

Despite high costs and taxes, these factors continue to reinforce California’s position as the center of U.S. innovation

ECONOMIC SNAPSHOT

Gold And Silver Price Plummets Don’t Worry Analysts—Here’s Why (Forbes, 4 minute read)

After a historic rally, gold and silver prices fell sharply late last week, with silver dropping as much as 30% and gold sliding nearly 10%, after President Donald Trump named Kevin Warsh as his pick to lead the Federal Reserve. The move rattled markets because Warsh is viewed as more hawkish on interest rates, which tend to weigh on precious metals, and it coincided with a rebound in the U.S. dollar

The selloff followed an extraordinary run in 2025, when gold rose up to 65% and silver surged about 150%, pushing prices to records above $5,600 for gold and $120 for silver

Despite the pullback, gold trading around $4,650 and silver near $77, analysts largely see the decline as temporary

JPMorgan expects gold to reach $6,300 by year-end, while Deutsche Bank forecasts $6,000, pointing to strong demand from central banks and investors despite ongoing volatility

US cuts tariffs on India to 18%, India agrees to end Russian oil purchases (Reuters, 4 minute read)

President Donald Trump said the U.S. has reached a trade deal with India that cuts U.S. tariffs on Indian goods to 18% from as high as 50%, after Prime Minister Narendra Modi agreed to lower trade barriers, curb purchases of Russian oil, and buy energy instead from the U.S. and potentially Venezuela. Modi also committed to purchasing more than $500 billion in U.S. energy, technology, agricultural, and other products

The announcement sparked a rally in Indian stocks, with major firms like Infosys (+3.5%), Wipro (+7%), and HDFC Bank (+3.4%) rising

The deal follows months of tense negotiations between the U.S. and India: India, which imports about 90% of its oil, has already begun reducing Russian crude purchases from roughly 1.2 million barrels per day in January to a projected 800,000 bpd by March

The U.S. economy in 2026: What to watch for (Standford Institute for Economic Policy Research, 7 minute read)

The U.S. economy heads into 2026 with continued growth but rising uncertainty. Consumer spending and real wages remain supportive, yet the job market has slowed, with unemployment rising to 4.4%. The Federal Reserve faces a stagflation risk as tariff-driven inflation pressures persist, with markets expecting up to two 25-basis-point rate cuts this year and leadership uncertainty as Chair Jerome Powell’s term ends in May. President Trump’s tariff regime has lifted the effective tariff rate from 2.1% to 11.7%, potentially adding about 1 percentage point to inflation

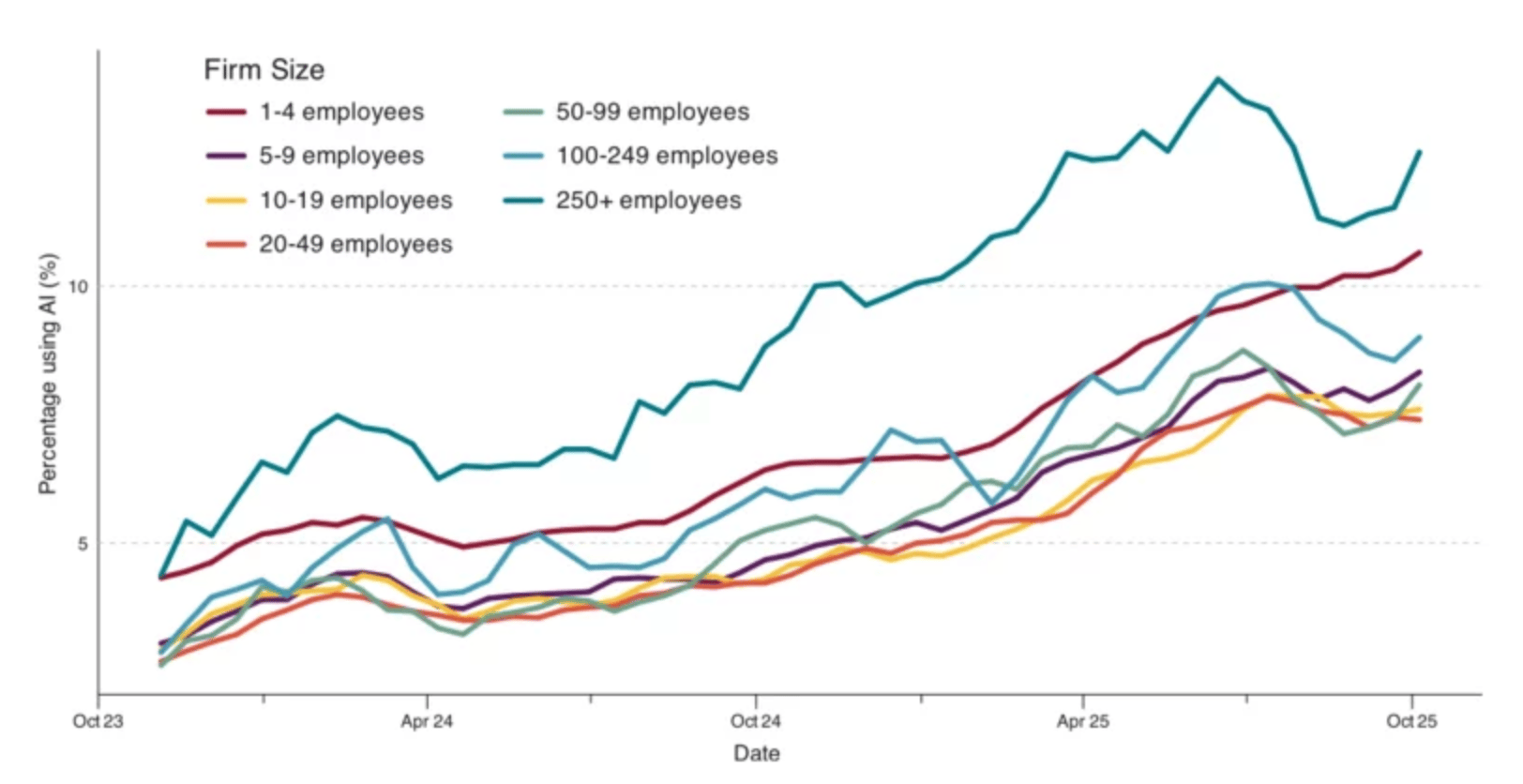

AI remains a central force, driving high valuations and heavy investment, with wealth effects contributing roughly $100 billion (0.4%) to GDP, even as its labor impact has been limited so far

Meanwhile, fiscal risks are mounting as deficits hover near 5.5–6% of GDP, leaving the economy resilient but increasingly exposed to policy missteps

AI usage by firm size 2024-2025. 4-week rolling average. Source: U.S. Census Bureau, Business Trends and Outlook Survey. Share of firms responding "yes" to the question "In the last two weeks, did this business use artificial intelligence (AI) in producing goods or services?"

U.S. Companies Are Still Slashing Jobs to Reverse Pandemic Hiring Boom (The Wall Street Journal, 6 minute read)

U.S. companies are entering a new phase of cost-cutting after years of pandemic-era overhiring, with large employers like Amazon, UPS, Pinterest, Verizon, Starbucks, and Nike leading significant job reductions. In 2025, U.S. employers announced 1.2 million job cuts, the highest since 2020, with tech (154,445 cuts) and logistics/warehousing (95,317) hit hardest as firms try to reduce bloat, layers of management, and expenses. While executives say most cuts are still about right-sizing rather than AI, companies are increasingly shifting spending toward automation and artificial intelligence, which is beginning to weigh on hiring and job security

Economists estimate AI already contributed to 5,000–10,000 net monthly job losses in 2025, potentially rising to 20,000 per month in 2026, even as the broader labor market remains relatively healthy

Hiring has slowed, unemployment spells are lasting longer, and many workers are being forced to adapt, as companies streamline operations and prepare for deeper workforce changes driven by technology

IPOs & EXITS

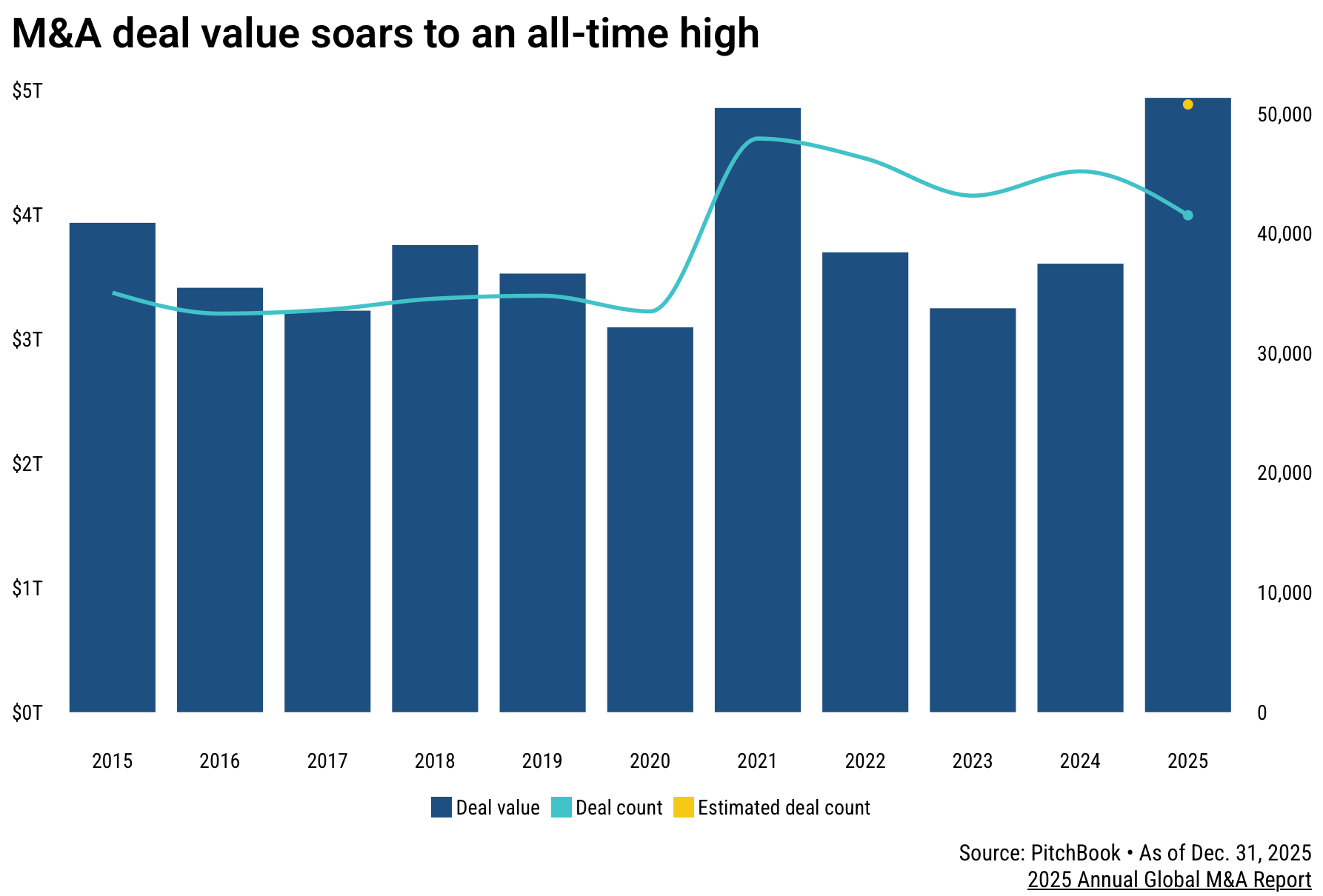

Big-ticket deals push M&A value to all-time high (PitchBook, 5 minute read)

Global M&A rebounded sharply last year, reaching a record $4.93 trillion in deal value, driven by a surge in billion-dollar-plus transactions, which made up 57% of total M&A, the highest share since 2015. Deals larger than $5 billion jumped to 122 transactions, up from 76 in 2024, with total value hitting a decade-high $1.58 trillion. The rebound was driven by lower interest rates, a more deal-friendly U.S. regulatory environment, and active strategic buyers, with corporate M&A climbing to $2.73 trillion, or nearly 60% of total deal value

Technology led mega-deals with a 27% share, supported by AI-driven investments in data infrastructure, while healthcare also saw major acquisitions

In contrast, deals under $1 billion continued to lose share, increasing pressure on smaller companies and investors to deliver high-quality performance to secure exits

SpaceX’s IPO could open the floodgates — and secondaries are booming in the meantime (TechCrunch, 4 minute read)

SpaceX is reportedly preparing for a potential 2026 IPO, lining up four major Wall Street banks in what could signal a reopening of the public markets after a multi-year IPO slowdown. In the meantime, late-stage private companies like SpaceX, recently valued at around $800 billion, are increasingly using the secondary market to provide liquidity for employees and early investors. According to Rainmaker Securities’ Greg Martin, demand for shares in bellwether private companies such as SpaceX, OpenAI, Stripe, Databricks, and Anthropic remains strong

Secondary prices often rise on IPO speculation, with some SpaceX shares trading toward a potential $1.5 trillion IPO valuation

As companies stay private longer and more value remains in private markets, the secondary market continues to grow, with Rainmaker trading over $1 billion in secondary transactions last year alone

Start your engines: OpenAI and Anthropic race to IPO (Fortune, 5 minute read)

IPO momentum is increasingly centered on AI, with OpenAI shaping up as one of the most consequential tests of the public markets in years. The company is reportedly pushing toward a Q4 IPO at a potential $500 billion valuation, even though it does not expect to reach profitability until 2030 and is projected to face a $207 billion cumulative gap between revenue and spending by then. Despite potentially generating up to $213 billion in revenue over that period, OpenAI is burning billions annually as it invests heavily in data centers and compute infrastructure

Its push to go public, partly to beat rivals like Anthropic, comes after a long IPO slowdown and will test whether investors still favor growth over near-term profits

A strong debut would boost confidence in AI-led IPOs heading into 2026, while a weak or discounted offering could signal cooling enthusiasm for capital-intensive AI companies

WHAT A TIME TO BE ALIVE

Women and Money: A System That Isn’t Equal (NBC Palm Springs, 4 minute read)

Managing money can be especially challenging for women due to persistent income and savings gaps, making financial confidence a critical issue. Women earn about 83–85¢ for every dollar earned by men, with the gap widening to 77–79¢ later in their careers, which limits their ability to save and invest. As a result, 37% of women say they’re unable to save money, compared with 22% of men, and about 28% of women do not contribute to retirement accounts, versus 18% of men

Fewer women have retirement accounts (64% compared with 70% of men)

Women also typically retire with about 30% less retirement income, and 38% say they feel behind on retirement savings

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team