- AlphaInsights by 8alpha.ai

- Posts

- Measuring the Jobs Pulse

Measuring the Jobs Pulse

Week of November 24th, 2025

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: A Lot Of Really Big Deals (Crunchbase, 5 min read)

Lambda (AI Cloud Infrastructure): San Francisco–based Lambda, a provider of AI cloud infrastructure, raised over $1.5 billion in Series E funding led by TWG Global. Founded in 2012, the company has now raised $3.2 billion in equity and debt

Kalshi (Predictions Market): New York–based Kalshi, a marketplace for trading on future events, raised $1 billion in a new round led by Sequoia Capital and CapitalG, valuing the 7-year-old company at $11 billion

Luma AI (Multimedia AI): Silicon Valley–based Luma AI, which builds AI-generated video and imagery tools, secured $900 million in a Series C round led by Humain, with significant participation from AMD

Kraken (Cryptocurrency): Crypto exchange Kraken raised $800 million across two tranches from investors including Jane Street, DRW Venture Capital, HSG, Oppenheimer, and Tribe Capital

Physical Intelligence (Robotics AI): San Francisco–based Physical Intelligence, which develops AI software for robotics, raised $600 million in a round led by CapitalG, reportedly valuing the company at $5.6 billion. Backers included Lux Capital, Thrive Capital, Jeff Bezos, Index Ventures, and T. Rowe Price

Unicorns Pick Up For The Second Month In A Row, Adding Close To $45B To The Board (Crunchbase, 5 min read)

In October, 20 new companies joined the Crunchbase Unicorn Board, adding a remarkable $44.5 billion in valuation, the largest single-month boost in three years. The U.S. led with 11 new unicorns, followed by China (3), Sweden (2), and one each from Europe, the U.K., Germany, Ukraine, and India

The highest-valued entrants were Reflection.AI at $8 billion and blockchain payments company Tempo at $5 billion

AI dominated the cohort, producing four new unicorns, including Reflection.AI, Fireworks AI, n8n, and LangChain ($1.25B)

October also saw notable exits: Stytch was acquired by Twilio, Nexthink by Vista Equity, and dbt Labs merged with Fivetran

Longer VC hold times make liquidity alternatives inevitable (PitchBook, 5 min read)

The venture market’s long liquidity freeze has pushed secondaries into the mainstream. With IPO timelines stretching, the median in Europe hit 7.3 years in 2025, up from 5.2 years in 2020, founders, employees, and early VCs are facing 15–18 year fund horizons and few ways to monetize equity. Pandemic-era fundraising also created a glut of VC-backed companies, adding selling pressure as private firms stay private to avoid volatile public markets

As a result, secondary activity has surged: the institutional VC direct secondaries market has hit $113B since 2015, including $14.7B in 2024, its highest level since 2021, rising from 1.3% to 4.2% of global VC exit value

Investors say this marks a structural shift, especially in Europe, as secondaries become an essential liquidity valve in a prolonged exit drought

5 charts to help decipher the great ‘AI bubble’ debate (PitchBook, 4 min read)

Investors are growing uneasy that the AI boom may be inflating into a bubble as tech companies pour unprecedented sums into data centers and infrastructure whose payoffs remain uncertain. Bank of America’s latest fund manager survey shows a majority now believe firms are over investing and should strengthen balance sheets instead. With AI data-center spending tripling since 2023 and total buildout needs estimated at $5T, even hyperscalers cannot finance the expansion alone, leaving a $1.4T funding gap that debt, private credit, or government spending would need to fill

Deals like Meta and Blue Owl’s $27B Louisiana data-center venture highlight the rising use of leverage, while private markets continue to bid AI valuations back to ZIRP-era highs

If revenue fails to match expectations, a correction could ripple across the sector, an outcome even Alphabet’s Sundar Pichai warned no company would escape, but for now, VCs remain aggressively deploying capital at record valuations

ECONOMIC SNAPSHOT

Americans are feeling the pain of the affordability crisis: ‘There’s not any wiggle room’ (The Guardian, 4 min read)

Americans are increasingly strained by soaring living costs, from groceries to housing and childcare, and many blame Washington, including President Trump, for failing to ease the affordability crisis. Prices for key grocery categories rose through 2025 (meat +4.5%, beverages +2.8%, produce +1.3%), while Trump’s trade-driven inflation and the 43-day government shutdown worsened household finances and depressed consumer sentiment, which fell to 51, near record lows

Trump is now backtracking by rolling back tariffs on items like coffee and bananas and floating ideas such as 50-year mortgages and $2,000 tariff-funded rebate checks

His response comes as Democrats win elections by focusing squarely on rising costs, capitalizing on voter frustration

Overdue jobs report shows employers added 119,000 jobs in September (NPR, 4 min read)

Hiring picked up modestly in September, with the delayed Labor Department report showing 119,000 jobs added and unemployment rising to 4.4%, but the broader picture points to a cooling labor market. Job gains were concentrated in health care and hospitality, while factories, warehouses, and the federal government cut jobs, and earlier months were revised down by 33,000. Fed Governor Chris Waller warned that the long “no-hire/no-fire” period is ending as businesses begin planning layoffs, echoed by cuts at Amazon (14,000) and Verizon (15,000)

The Fed remains sharply divided on further rate cuts next month, especially as Trump’s tariffs keep inflation elevated and the 43-day shutdown has left policymakers missing key October and November jobs and inflation data

With immigration curbed and baby boomers retiring, worker supply has shrunk, but Waller fears weakening labor demand is the real issue, setting the stage for potentially rising unemployment ahead

US tech stocks slide as traders fret over ‘frothy’ AI valuations (Financial Times, 5 min read)

US tech stocks fell sharply Tuesday as concerns over stretched AI valuations deepened ahead of Nvidia’s earnings. The Nasdaq dropped 1% and the S&P 500 fell 0.6%, with Nvidia down 2%, Microsoft and Amazon down 3%+, and Meta off 1.5%. Investors are increasingly worried the AI rally has become disconnected from fundamentals, especially as Big Tech has issued $81B in debt since September to finance massive data-center spending. A Bank of America survey showed a majority of fund managers believe companies are over investing in AI

This is the first time this has been true since 2005, amid forecasts that AI capex could reach $7T by 2030

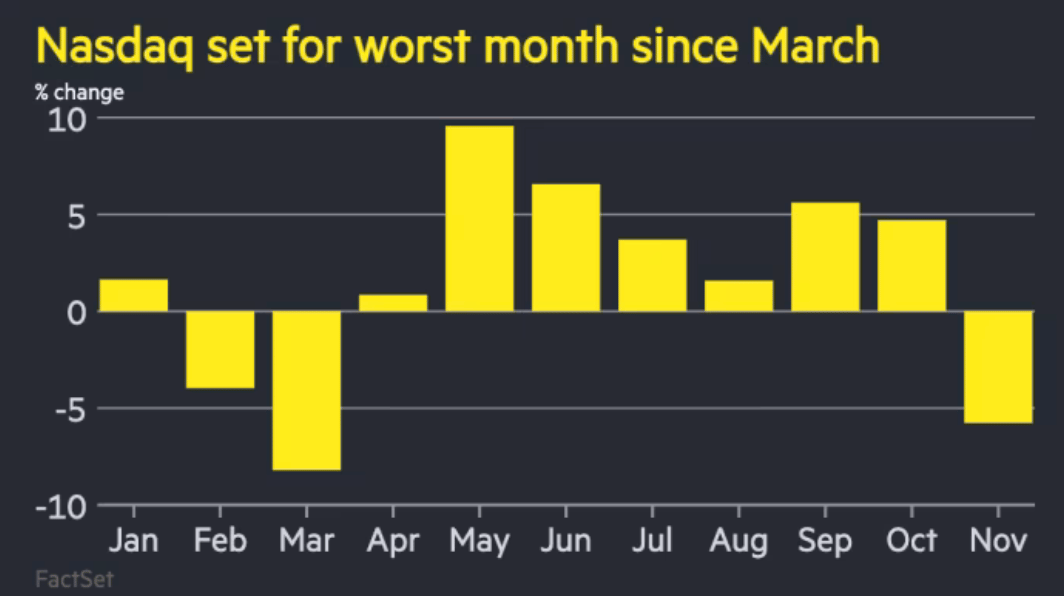

The Nasdaq is already down 5%+ in November, putting it on track for its first losing month since March, while the VIX jumped 11% to 25

Global markets followed lower, with Europe’s Stoxx 600 down 2.1%, Germany’s DAX off 1.8%, South Korea’s Kospi down 3.3%, and Hong Kong’s Hang Seng down 1.7%

Nvidia didn’t save the market. What’s next for the AI trade? (Yahoo Finance/Bloomberg, 6 min read)

Wall Street remains sharply divided on the AI trade despite Nvidia’s blockbuster earnings, which failed to calm mounting bubble fears. Nvidia’s shares swung from a +5% jump to a –3.2% drop, dragging the S&P 500 and Nasdaq into the red as investors questioned whether the industry’s hundreds of billions in AI spending can deliver adequate returns. Skeptics warn valuations are overstretched, financing is increasingly circular and debt-driven, and cracks are emerging as chip stocks fall, the semiconductor index is down 11% in November, with AMD and Arm off 20%+

Optimists see the pullback as a healthy pause, arguing Big Tech’s capex boom, projected to rise 34% to $440B across Microsoft, Amazon, Meta and Alphabet, shows the AI cycle is still early

Even so, ROI concerns are rising: Meta is down 21% since earnings, Microsoft 13%, Oracle 24%, and CoreWeave 46% as investors scrutinize spending plans

Despite Nvidia’s “exceptional” quarter, investors want proof that the massive investment will translate into actual revenue and margin expansion

IPOs & EXITS

AI boom brings fresh risks to US markets, and more money to M&A (Reuters, 4 min read)

AI-driven M&A is accelerating as companies race to acquire capabilities they can’t build in-house, pushing deal valuations to historic highs. Lazard’s Matthew Danzig said nearly every potential target is now crafting an “AI angle” to command acquisition premiums, as corporate buyers rush to purchase models, teams, and proprietary datasets. This buying spree is unfolding despite the massive capital needs of the AI industry: McKinsey estimates $7 trillion will be required by 2030 just for data centers

To finance acquisitions and AI expansion, companies are issuing increasingly risky debt—high-quality corporates are selling 30–40-year bonds to fund assets that may depreciate in just four years

Lower-rated tech firms are flooding the market with zero-coupon convertibles, a pattern last seen before the downturns of 2001 and 2021

With hundreds of billions flowing into acquisitions and infrastructure, analysts caution that a single misstep in the AI M&A cycle could trigger outsized market shocks

India’s IPO market is booming. And it’s luring global companies to list local units (CNBC, 3 min read)

Multinational companies (MNCs) are rushing to list their India subsidiaries to capture a significant valuation premium, even as foreign investors remain net sellers. Recent and upcoming floats, including Coca-Cola’s planned $1B IPO and CJ Darcl Logistics’ filing, follow successes like Siemens Energy India trading at 117× earnings (vs. 60× for its German parent) and LG Electronics India valued at ₹1.13T ($12.6B) with a 58× P/E despite one-tenth the parent’s profit. Analysts say faster local growth, strong corporate governance, and India’s deep domestic liquidity are driving demand

With SIP-fueled retail participation enabling large offerings (e.g., $3B in back-to-back IPOs for Tata Capital and LG), MNCs are monetizing holdings through offers for sale, which account for over two-thirds of 2025 IPO proceeds

Despite concerns about shifting risk to domestic investors, MNCs still retain ~75% stakes post-listing, and experts say these deals validate India’s market depth and may ultimately attract more long-term FDI

WHAT A TIME TO BE ALIVE

Why now is the best time to invest in climate tech (TechCrunch, 4 min read)

New IEA data suggests climate tech may not be entering a “winter” at all, but instead an inflection point: global emissions forecasts for 2040 have improved dramatically in just a decade, shifting from 46 gigatons expected in 2014’s worst-case scenario to 38 gigatons today, and potentially 33 gigatons if countries meet current pledges. The change reflects rapid deployment of cheap solar, wind and batteries, alongside record EV adoption (even without subsidies, as seen in Germany) and China’s commitment to peak emissions before 2030

While the world remains off track for net zero by 2050, the pace of improvement, a 13-gigaton swing in ten years, suggests accelerating momentum

For investors, this signals that despite gloomy sentiment, climate tech may be at the start of another major growth wave driven by geothermal, grid optimization software, and next-generation clean energy technologies

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team