- AlphaInsights by 8alpha.ai

- Posts

- Gov’t Reopens, Investor Confidence Doesn’t

Gov’t Reopens, Investor Confidence Doesn’t

Week of November 17th, 2025

Welcome to AlphaInsights, 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and key updates from the dynamic world of venture capital!

From billion-dollar rounds to market-defining shifts, we deliver the intelligence powering the global investment landscape, moving investors and innovators forward. At 8alpha.ai, we’re not waiting for the future of capital, we’re building it. Stay sharp, stay curious, and stay ahead.

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: AI And Defense Tech Take The Lead (Crunchbase, 5 min read)

Anysphere (AI coding): San Francisco–based Anysphere, the parent company of AI coding platform Cursor, raised $2.3 billion in Series D funding at a $29.3 billion valuation. The round was backed by Accel, Thrive Capital, Andreessen Horowitz, DST Global, Coatue, Nvidia and Google

Chaos Industries (Defense tech): Los Angeles–based Chaos Industries, which builds counter-drone radar and communications systems, secured $510 million in new funding at a $4.5 billion valuation. The round was led by Valor Equity Partners

D-Matrix (AI infrastructure): Santa Clara–based D-Matrix, a developer of generative-AI inference compute for data centers, closed $275 million in Series C funding at a $2 billion valuation. Bullhound Capital, Triatomic Capital and Temasek led the round

Gopuff (Fast delivery): Philadelphia-based Gopuff, which offers rapid delivery of groceries and everyday items, raised $250 million in new funding. The round was led by Eldridge Industries and Valor Equity Partners

Forterra (Defense autonomy): Clarksburg, Maryland–based Forterra, a provider of autonomous systems for defense applications, raised $238 million in Series C equity and debt financing. The round was led by Moore Strategic Ventures

Global investors pull back, cautious over tech valuations and US labour (Reuters, 4 min read)

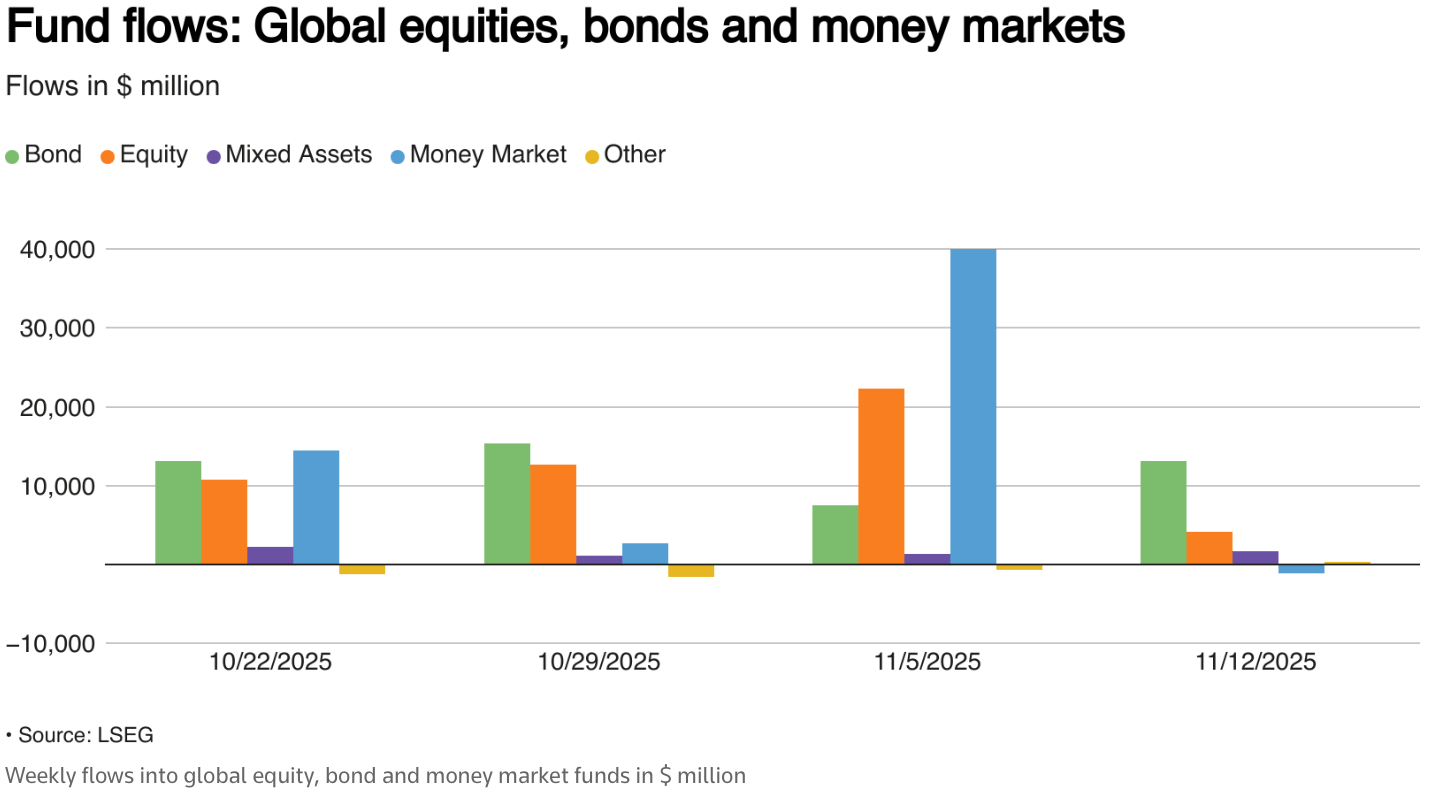

Global equity inflows dropped sharply in the week to November 12, falling to just $4.11B from $22.27B the week before, as worries over stretched tech valuations and signs of a weakening U.S. labor market pushed investors into risk-off mode. Sentiment worsened after a private report suggested U.S. job losses in October and after SoftBank disclosed a $5.83B sale of Nvidia shares. Regionally, Asian equity funds led with $3.04B in inflows, the U.S. saw $1.15B, while Europe posted $1.87B in outflows

Sector flows showed tech attracting $2.59B, its lowest in four weeks, with healthcare and industrials adding $915M and $326M, respectively

Bond funds remained resilient with $13.11B in inflows, the 30th straight week, driven by short-term bond funds ($5.77B), euro bonds ($2.31B), and corporates ($1.9B)

Commodity funds rebounded with $1.64B into gold and metals, while emerging-markets equity funds gained $2.17B, even as EM bond funds saw another $1.45B in outflows

ECONOMIC SNAPSHOT

Stocks and bitcoin slide as nerves fray ahead of Nvidia earnings (CNN, 4 min read)

US markets opened the week in a risk-off mood, with the Dow falling 557 points (-1.18%), the S&P 500 down 0.92%, and the Nasdaq off 0.84%, while the VIX jumped 13% and sentiment slid into “extreme fear.” Investors are bracing for two major catalysts: Nvidia’s earnings on Wednesday, especially important as the AI leader now makes up ~8% of the S&P 500 and has driven much of this year’s rally, and Thursday’s long-delayed September jobs report

Nvidia slipped 1.8% as worries over expensive AI valuations and huge data-center spending weighed on sentiment, helping drag the Nasdaq about 5.5% below its late-October peak

Bitcoin also slid below $92,000, erasing its 2025 gains, while tech and crypto-linked stocks led the declines

Traders now assign just a 45% chance of a December Fed rate cut (down from 94% a month ago), adding to nerves as markets test key support levels and rotate out of high-flying tech into cheaper sectors

Treasury secretary says ‘we will see’ about $2,000 rebate checks to Americans as Supreme Court weighs Trump’s tariffs (CNN, 3 min read)

Treasury Secretary Scott Bessent said President Trump’s proposal to send $2,000 tariff rebate checks to most Americans would require congressional approval, despite Trump repeatedly promoting the idea as a way to return tariff revenue to “working families.” The plan faces legal uncertainty as the Supreme Court reviews Trump’s use of emergency powers to impose broad tariffs, raising the possibility that large portions could be struck down

Bessent also said the administration hopes to finalize a rare-earth trade deal with China by Thanksgiving, after threatening 100% tariffs unless Beijing drops export controls

To ease rising food costs, groceries are up 2.7% YoY, coffee 21%, and bananas 6.6%, the administration exempted many agricultural imports from tariffs

Still, consumer sentiment has deteriorated sharply, falling to 50.3 in November from 53.6 in October, signaling deep anxiety heading into the holidays

Will the Fed’s minutes throw any new light on US interest rates? (Financial Times, 5 min read)

The Federal Reserve’s minutes from its October meeting will be published on Wednesday. They arrive at a moment of growing uncertainty over a potential December rate cut. The Fed lowered rates to 3.75%–4% in October, and markets had fully priced in another 25 bp cut before Chair Powell warned it was “not a foregone conclusion.” Several Fed officials have since echoed that caution

The 43-day government shutdown has also left major holes in labor and inflation data, giving policymakers what analysts describe as an “incomplete picture” heading into the next meeting

Some missing jobs data may be released in the coming week

Still, the absence of key indicators has already complicated market expectations and the Fed’s ability to assess the true state of the US economy

After weekend scandal at the Fed, Congress will look at its own stock trading in the days ahead (Yahoo Finance, 4 min read)

A fresh ethics scandal involving former Fed governor Adriana Kugler, whose disclosures revealed previously unreported 2024 stock trades, including during the Fed’s blackout period, has reignited Washington’s long-running debate over banning stock trading by public officials. The timing is significant: the House Administration Committee will hold its first hearing in years on Wednesday to examine tightening or fully banning lawmakers’ trades under the STOCK Act, which currently allows trading if disclosed within 30 days

Momentum for a ban has been building after repeated controversies, from pandemic-era trades to hundreds of tariff-timed transactions earlier this year

Polls show 86% of Americans support prohibiting members of Congress and their families from trading individual stocks

A bipartisan bill, the Restore Trust in Congress Act, would ban lawmakers, spouses, and dependents from owning or trading individual securities, and supporters say they may force a House vote if leadership stalls

IPOs & EXITS

US government shutdown ends—but the damage to the IPO environment has been done (PitchBook, 3 min read)

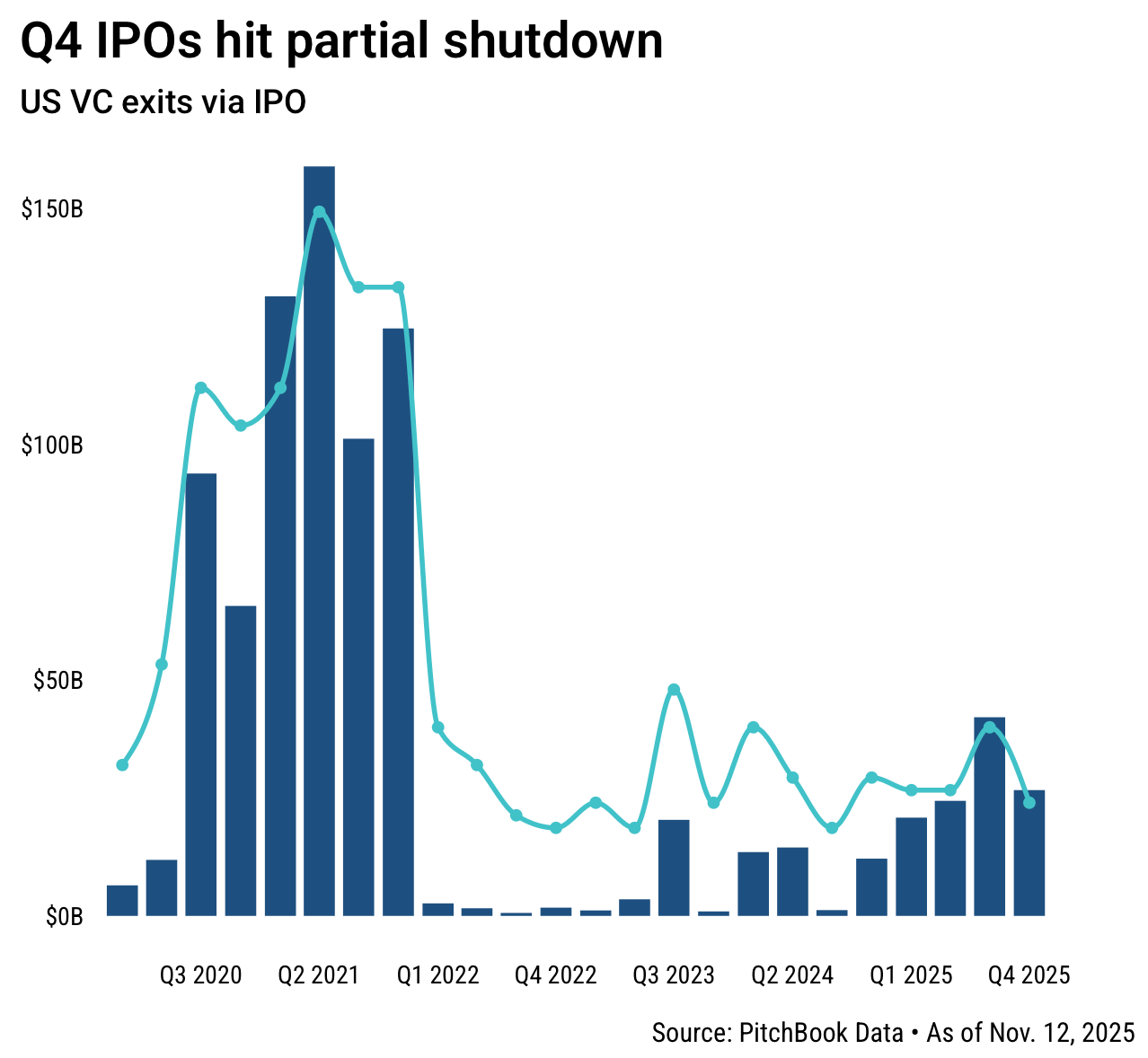

The 43-day U.S. government shutdown is over, but an IPO rebound is unlikely in the near term. Bankers note that even with the SEC reopening, companies can’t “rush out” to go public. Q4 IPO momentum, already weak, has been further derailed. This comes after Q3 delivered the strongest IPO quarter in nearly four years, with 15 VC-backed IPOs generating $42.1 billion in exit value. But shutdown-era listings have struggled: Navan fell 20% on its first day

Experts say the traditional Labor Day–Thanksgiving IPO window effectively closed early due to volatility tied to “liberation day” tariff shocks and policy uncertainty

Hopes that postponed Q4 deals would shift to Q1 2026 are fading: companies must file updated 2025 year-end audits by mid-February, leaving little time to re-enter the queue

Even with plenty of “IPO-ready” companies, bankers say volatility and policy uncertainty prove the IPO market can’t count on stable windows anymore

Lackluster Returns Dampen Outlook for US Firms Waiting on IPOs (Bloomberg, 5 min read)

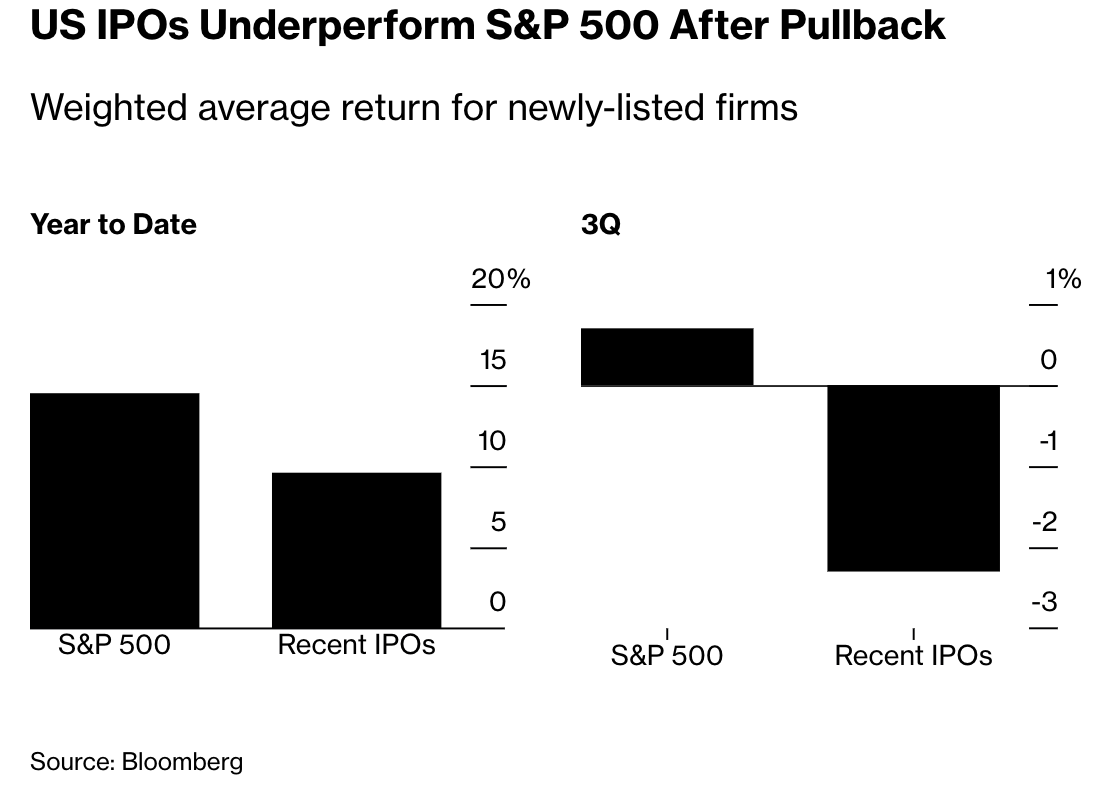

US IPOs are taking a disproportionate hit during this month’s stock market pullback, adding new hurdles for companies hoping to go public before year-end. Shares of recent debuts, including Gemini Space Station, Fermi, Navan, and StubHub, have quickly fallen below their IPO prices, while even 2025’s star performers like CoreWeave, Circle, and Figma have slumped

As a result, this year’s US IPO cohort is up just 9.7%, well below the S&P 500’s ~15% gain

The timing is difficult: the end of the 43-day government shutdown was expected to clear the path for a final burst of IPO activity

Several companies are now ready to launch offerings before Christmas, though many will struggle to fit marketing efforts around the late-November holiday

US VC Secondary Market Watch (PitchBook, 20 min read)

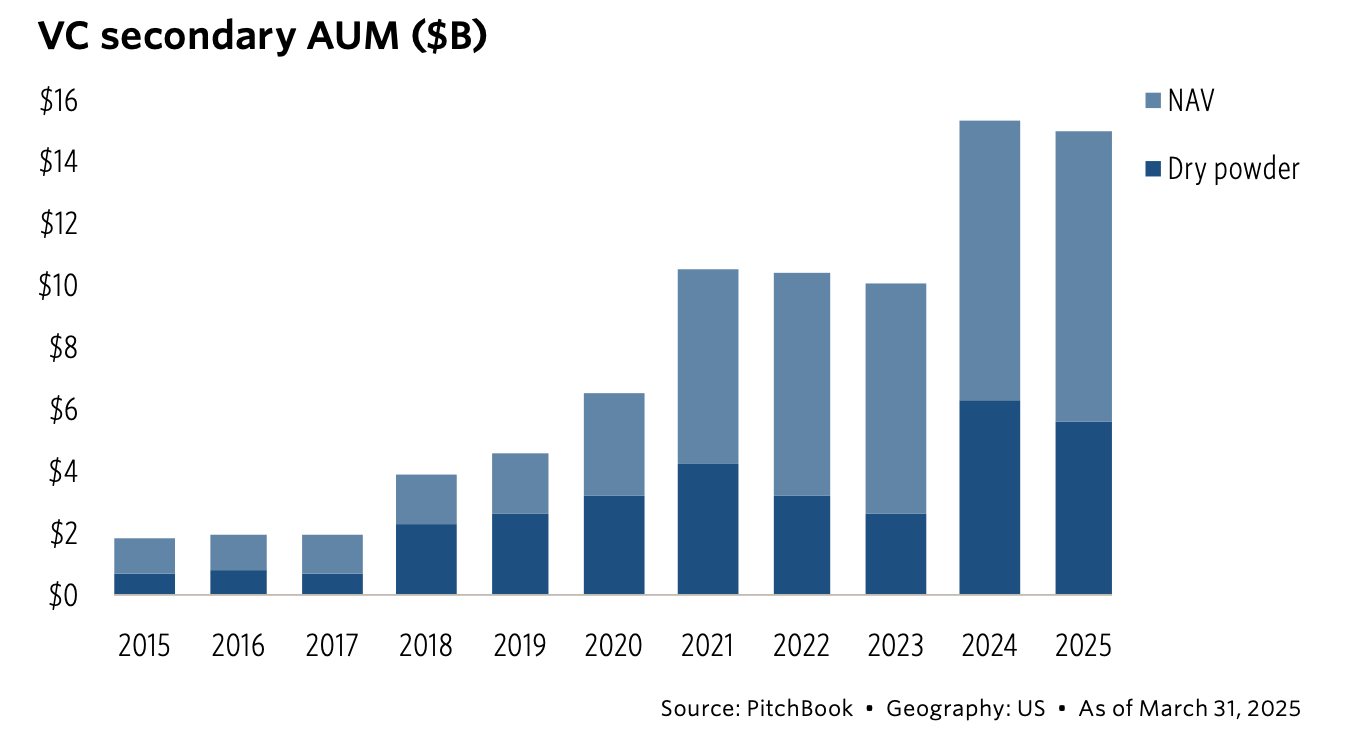

The US VC secondary market surged to $94.9B in Q3 2025 across direct and GP-led deals, highlighting its growing role as a liquidity lifeline despite remaining small, only 2.6% of unicorn value and 37.8% of primary exit value. Liquidity improved at the top end: Figma’s IPO helped lift YTD exit values beyond 2022–24 totals, though broader IPO activity remains muted, making the rebound selective rather than widespread

Direct secondaries accelerated sharply to an annualized $80.3B (up 31.4% QoQ), while GP-led deals reached $14.6B, with modest growth ahead

Trading remains heavily concentrated, with the top 20 startups accounting for 95.6% of volume due to severe information asymmetry and tight company controls over secondary transfers

Dry powder for dedicated venture secondary funds totaled $5.7B as of March 2025, but that’s only 1.8% of the capital sitting in primary VC funds, showing how small the secondary pool still is compared with the broader venture market

WHAT A TIME TO BE ALIVE

Big Tech’s Climate Strategists Feeling Strain of AI Power Needs (Bloomberg, 5 min read)

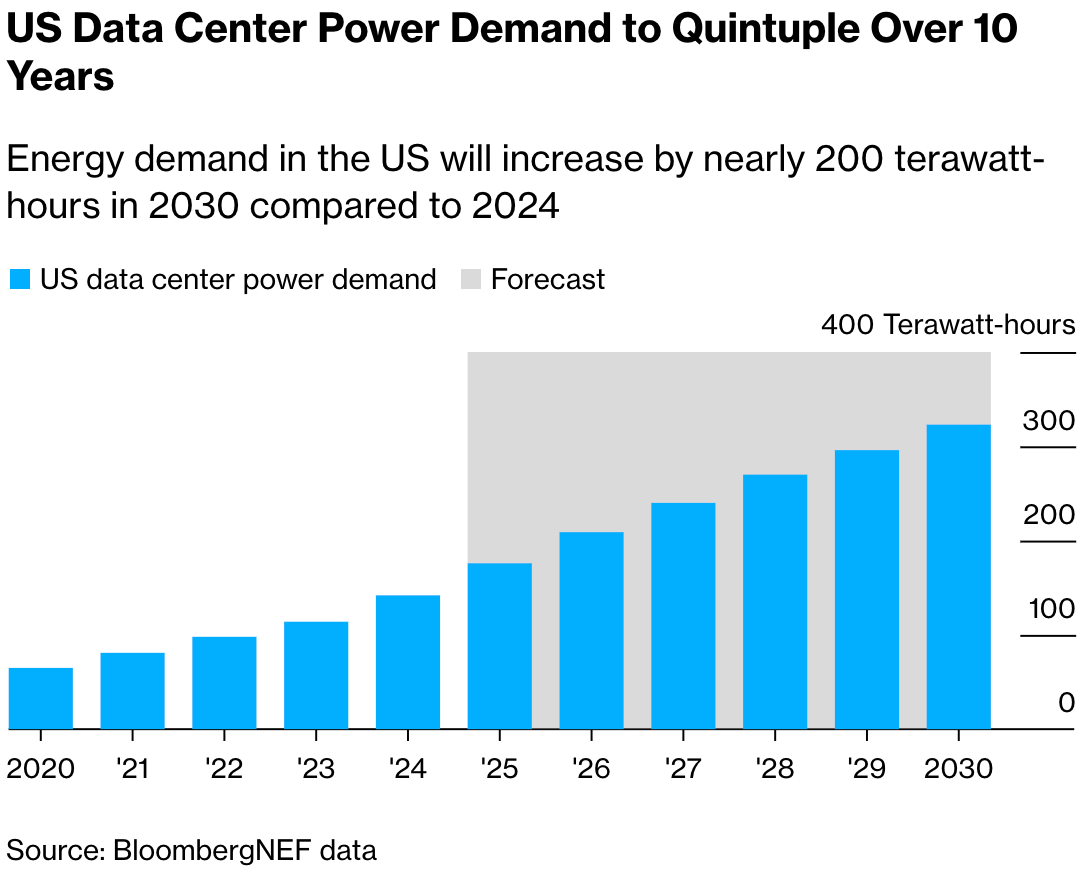

The AI boom has triggered an unprecedented power crunch for Big Tech, forcing Microsoft, Amazon, Google, and Meta to hunt for vast new electricity supplies even as their emissions climb. Hyperscalers bought 9.6 GW of U.S. clean energy in H1 2025, but that barely dents the 362 GW of additional power AI data-centers will need globally by 2035, with U.S. demand alone expected to quintuple by 2030. Data-center construction has exploded into one of the world’s largest industrial buildouts, with hyperscale sites sprawling across hundreds or even thousands of acres and requiring gigawatts of dedicated power, Meta’s Louisiana “Hyperion” campus, which may consume up to 5 GW, is now larger than Manhattan

To avoid outages and meet growth targets, companies are increasingly turning to natural gas plants, nuclear restarts, geothermal projects, and behind-the-meter generation built directly next to data-centers

Emissions have surged, Meta up 64%, Google 51%, Amazon 33%, Microsoft 23%, underscoring how AI demand is colliding with long-standing climate commitments

Trump’s rollback of renewable incentives, projected to cut future clean-energy deployment by 21% (or 227 GW) by 2035, intensifies the supply crunch

AI8 VENTURES HIGHLIGHT

State of VC Report: The AI Power Law

“Every technological revolution has two halves: the bubble and the golden age that follows.”

The stock market is at all-time highs, but inflation remains sticky and the job market is weakening. Ask around and you’ll hear the same refrain: the labor market feels tougher than ever. At the same time, the first wave of AI agents is “joining the workforce”. Imagine a software engineering agent capable of performing most tasks of a mid-level developer. Now imagine thousands. Extend that across every knowledge field, and the implications for productivity, and potential displacement, are profound.

What happens when the next round of layoffs hits? Add tariffs on top, and ask what happens if consumption weakens. Even the Federal Reserve admits it is unsure of what comes next.

Against this backdrop, venture capital in 2025 is not in recovery but in recalibration. The illusion of recovery is powered almost entirely by AI. Capital is flowing, but to fewer companies than ever. Outside AI, down rounds are rising, and nearly half the unicorn population hasn’t raised since 2022.

We are living in an AI bubble. Just four megacaps, Nvidia, Meta, Microsoft, and Broadcom, accounted for 60% of the S&P 500’s gains, with Nvidia alone responsible for more than a quarter. It’s a paradox. Yes, we’re in a bubble, but it’s also the future. We are witnessing what may be the most important technological shift in a generation. It’s hype layered on top of something undeniably real.

Uncertainty is the name of the game; not one single path forward, but divergent scenarios. Alpha will be earned through selectivity, by navigating volatility rather than avoiding it.

8alpha.ai is an AI fintech transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside. We’re the architects building financial infrastructure for the next generation of investors and startups.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team