- AlphaInsights by 8alpha.ai

- Posts

- Fake Economic Data?

Fake Economic Data?

Week of August 18th, 2025

Welcome to 8alpha.ai’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s 10 Biggest Funding Rounds: Therapeutics And AI Lead, While Megarounds Took A Breather (Crunchbase, 5 minute read)

SetPoint Medical (Biotechnology): Raised $140M—$115M Series D led by Elevage Medical Technologies and Ally Bridge Group, plus $25M Series C tranche. Valencia, CA-based developer of rheumatoid arthritis and autoimmune therapies

Titan (Enterprise Software): Raised $74M from General Catalyst. New York, NY-based provider of AI-enabled IT tools; acquired IT/cybersecurity firm RFA

Vulcan Elements (Manufacturing): Raised $65M Series A at $250M valuation led by Altimeter. Durham, NC-based maker of rare earth magnets for military contracts

Reprieve Cardiovascular (Medical Device): Raised $61M Series B led by Deerfield Management. Milford, MA-based developer of acute heart failure therapies

1Kosmos (Cybersecurity): Raised $57M Series B, including $10M credit line, from Forgepoint Capital, Oquirrh Ventures, and Bridge Bank. Iselin, NJ-based passwordless authentication provider

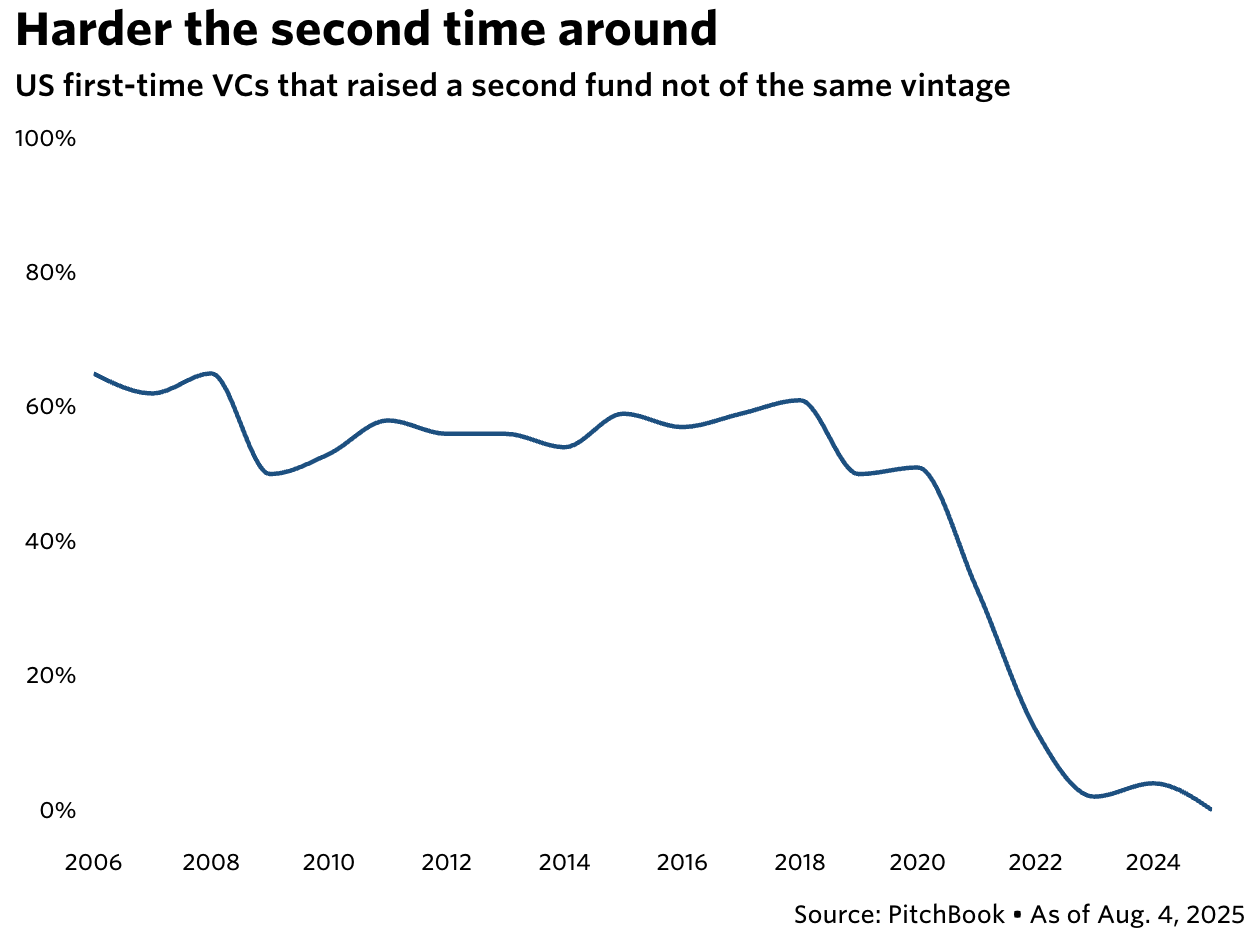

1st-time VCs face 2nd-fund slump (Pitchbook, 3 minute read)

First-time VC managers who launched funds during the record fundraising years of 2021 and 2022 are facing a far tougher environment raising second vehicles, as economic and political uncertainty dampens LP appetite. Only 33% of managers who debuted in 2021 have secured a second fund, and just 12% of those from 2022 have done so, well below the historical norm of under three years between funds

In contrast, capital is increasingly concentrated among large, established firms, with only 12 managers capturing more than half of all U.S. venture commitments in H1 2025

Industry voices cite multiple headwinds: LP overexposure to venture after the boom years, weak recent returns, and a shift toward “power law” investing that sidelines mid-tier managers

Climate-focused funds are additionally challenged by the Trump administration’s rollback of clean energy policies, eroding the momentum that once fueled the sector

Enterprise GenAI Startup Cohere Confirms $500M Raise At $6.8B Valuation And Taps Ex-Meta VP As New AI Chief (Crunchbase, 5 minute read)

Cohere, a Toronto-based generative AI startup founded in 2019 by ex-Google researchers including “Attention Is All You Need” co-author Aidan Gomez, has raised $500 million at a $6.8 billion valuation, confirming earlier reports it sought over $500 million at above $5.5 billion. The round was co-led by Inovia Capital and Radical Ventures, with participation from AMD Ventures, Nvidia, PSP Investments, Salesforce Ventures, and others, bringing Cohere’s total funding to about $1.5 billion

Specializing in cloud-agnostic, enterprise-grade AI rather than consumer apps, Cohere builds custom models for clients such as Dell, Notion, and Oracle, capable of deployment across public clouds, private clouds, or on-premise

Over the past year, it launched new generative and retrieval models and its flagship “security-first” agentic AI platform, North

The raise comes amid unprecedented AI investment momentum—nearly half of all U.S. venture funding over the past year went to AI, with Q1 2025 marking a record $59.6 billion invested globally, accounting for 53% of total venture funding

Unicorns Raising Fast Follow-On Rounds Are Mostly — But Not Only — An AI-Centric Bunch (Crunchbase, 4 minute read)

A growing group of ultra-hot U.S. unicorns—many in AI—are raising massive funding rounds just months apart, driven by ambitious growth plans, large cash needs, and strong investor demand. In generative AI, leaders like OpenAI, Anthropic, and xAI have collectively secured over $90 billion to date, with companies often waiting less than seven months between raises. Vertical AI players are also moving quickly. Anysphere, maker of AI coding assistant Cursor, closed a $900 million round at $9.9 billion in June—its third in under a year

Beyond AI, defense tech is seeing a surge, led by Anduril Industries with over $6.1 billion raised to date

Fintech examples include Ramp ($500 million in July) and Bilt Rewards ($250 million weeks later)

Many of these unicorns are also achieving soaring valuations—OpenAI is reportedly targeting $500 billion, while Anthropic is eyeing $170 billion—underscoring the intense capital concentration and investor enthusiasm in today’s top-tier startups

ECONOMIC SNAPSHOT

What would happen if America started faking its economic data? Here’s what happened when other countries did it (CNN, 6 minute read)

President Donald Trump’s firing of Bureau of Labor Statistics (BLS) chief Erika McEntarfer after weak July jobs data has raised global concern about the credibility of U.S. economic reporting. While there’s no evidence that the data was manipulated, Trump’s move to replace McEntarfer with a partisan nominee has drawn comparisons to Greece and Argentina, both of which faced severe financial consequences after publishing falsified statistics. Trump accused McEntarfer of manipulating reports “for political purposes,” though former officials stressed commissioners cannot alter locked-in data

Economists warn that politicizing the BLS could undermine confidence in the $2 trillion U.S. inflation-linked securities market and broader global trust in U.S. statistics

The U.S. economy, however, remains stronger than past examples of data manipulation, growing at an annualized 3% in Q2 with overall output above $30 trillion

Analysts warn tariffs and service costs could still be a problem, but most agreed the data support stock gains, limit short-term risks, and keep the door open for Fed rate cuts at the next three meetings

Wall Street now sees 3 Fed rate cuts before year-end (CNBC, 5 minute read)

July’s U.S. inflation came in slightly cooler than expected, with CPI up 2.7% year-over-year versus a 2.8% Dow Jones estimate, sparking a market rally and boosting expectations for multiple Fed rate cuts this year. According to CME FedWatch data, markets now see a 91.8% chance of a September cut (up from 85.9%), 66.3% in October (55.1%), and 56.7% in December (45%)

Core CPI rose 3.1%, above the 3.0% consensus, reflecting continued pressure from core goods and services, partially offset by lower energy and shelter costs

Strategists generally agreed the report supports at least one rate cut in September—possibly 50 basis points—with some viewing tariff effects as transitory, mitigated by inventory drawdowns and cautious pricing

Trump extends China tariff deadline by 90 days (CNBC, 3 minute read)

Last Monday, President Donald Trump extended the suspension of high U.S. tariffs on Chinese goods for another 90 days, delaying their scheduled snapback until mid-November. Without the extension, duties would have returned to April’s peak levels of 145% on Chinese imports, with China retaliating at 125% on U.S. goods. The pause follows late-July trade talks in Stockholm and maintains the reduced rates agreed in May—30% U.S. tariffs and 10% Chinese tariffs—after both sides temporarily eased their trade war measures

The move underscores Trump’s unpredictable, on-again/off-again tariff approach, which has frequently shifted with little notice

Trump also urged China to “quickly quadruple” its U.S. soybean purchases to help cut its trade deficit with the U.S., a comment that pushed Chicago soybean prices higher, though no agreement from Beijing was confirmed

Trump tariffs live updates: US again warns India on buying Russian oil, EU-US deal details in question (Yahoo Finance, 2 minute read)

White House trade advisor Peter Navarro warned India against “cozying up” to Russia and China through oil purchases, writing in the Financial Times that India must “start acting” like a U.S. strategic partner. Earlier this month, President Trump imposed an additional 25% tariff on Indian goods, bringing total U.S. tariffs on Indian imports to 50%, citing New Delhi’s continued Russian oil purchases

Tensions are also rising with other partners. Germany has insisted that U.S. tariffs on Europe-made cars be lowered before the EU-U.S. trade deal can be finalized, while EU officials are pushing to block Washington from challenging its digital regulations

Several allies, including the UK on steel, are still waiting for promised tariff exemptions to be formalized

Trump recently unveiled sweeping “reciprocal” tariffs on dozens of trade partners, with upcoming negotiations expected with Canada, Mexico, and China in the coming months

IPO & EXITS

Gemini Plans to Go Public via Nasdaq as Crypto IPOs Boom (Decrypt, 3 minute read)

Gemini, the cryptocurrency exchange founded in 2014 by Tyler and Cameron Winklevoss, has publicly filed an S-1 with the SEC to launch an IPO on the Nasdaq Global Select Market under the ticker GEMI. The company has not yet disclosed the number of shares to be offered, the price range, or the target raise amount. The environment is being boosted by a friendlier U.S. regulatory stance under President Trump, including the SEC dropping most lawsuits against crypto companies and the signing of the GENIUS Act stablecoin bill in July 2025

The public filing follows a confidential submission in June 2025, and comes amid strong investor demand for crypto IPOs

Circle, the USDC stablecoin issuer, raised funds at an offering price of $31 per share in June; its stock peaked at $299 before settling to $149 as of Friday’s close

Bullish, a crypto exchange for institutional clients, debuted at $37 per share this week, surged to $118 intraday, and closed Friday at $84, giving it a market capitalization of $12.2 billion

Trump-fueled crypto frenzy sparks rush to Wall Street IPOs (Reuters, 5 minute read)

U.S. cryptocurrency companies are rushing to go public, buoyed by friendlier policies under President Donald Trump’s second administration and a record $4.2 trillion global crypto market valuation. Along with Bullish (BLSH) and Circle (CRCL), whose blockbuster performance was widely seen as a green light for the industry, BitGo, Grayscale, and Gemini have also filed confidentially for IPOs, while Kraken is viewed as a likely candidate

The rally in digital assets adds further momentum, with Bitcoin closing Tuesday 12th at $120,181.98 and forecast to hit $200,000 by year-end, while Ether is expected to climb from $4,619.73 to $7,500

This flurry of activity comes amid a broader U.S. IPO market rebound, with 216 offerings so far in 2025 raising $39.83 billion, up from 118 in the same period last year

High-profile debuts from firms like Klarna, Genesys, Chime, and Figma are expected this fall, though sentiment remains sensitive to market volatility

Recent IPO Stock Gains Suggest a 'Spillover' Effect Could Boost Upcoming Debuts (Investopedia, 4 minute read)

Pent-up demand is driving strong IPO performances in 2025, with U.S. offerings raising at least $100 million posting a median first-day gain of about 19%—the highest since 2020’s 33%, per Renaissance Capital. Its index of large IPOs under three years old is up 12% year-to-date, outperforming the S&P 500’s 8.6% gain. Recent standout debuts include NewsMax, FatPipe, Circle, AIRO, Figma, and crypto exchange Bullish, all of which at least doubled on day one, creating a “spillover” effect for upcoming deals like StubHub’s planned September listing

Venture-capital-backed tech companies dominate the top performers, with 9 of the 10 largest VC-backed U.S. IPOs in 2025 seeing big first-day pops

CoreWeave was the exception, debuting below range but rallying nearly 250% since March

However, experts caution that extreme first-day surges often lead to lower long-term returns, as lofty valuations—reflected in high price-to-sales ratios—can be hard to sustain

WHAT A TIME TO BE ALIVE

Beyond Cathie Wood, More Women Are Dominating The Investment Space (Forbes, 4 minute read)

Women are playing a growing role in reshaping the investment landscape. According to the Female Founders Fund, women now hold 17% of decision-making roles at U.S. venture capital firms—nearly triple the share in 2014. McKinsey estimates that U.S. women controlled $18 trillion in investable assets in 2023, up from $10 trillion in 2018, and projects this figure will reach $34 trillion by 2030

This influence is also visible in entrepreneurship: 13 new women-founded startups reached unicorn status in 2024, bringing the global total to over 120, many powered by the AI boom

Yet funding gaps persist. Women-only founding teams captured just 2.1% of total VC in 2024, down slightly from 2.4% in 2014, and continue to receive smaller checks and valuations compared to male-led peers

Closing the funding gap will require intentional investment, particularly in early-stage ventures where access to capital is hardest

AI8 VENTURES HIGHLIGHT

The Illusion of Recovery - Venture Capital 2025

“We’re bringing wealth back to America. That’s a big thing... It takes a little time, but I think it should be great for us.”

We are living in a world defined by rapid and accelerating change, political, economic, social, and technological. This is not a typical business cycle. We are in an era shaped by powerful megatrends, with AI transforming industries, geopolitical shifts reshaping markets, and macroeconomic forces creating new uncertainties.

Just weeks before the 2024 election, The Economist described the U.S. economy as the “envy of the world.” After Donald Trump’s victory in November, markets initially anticipated controlled inflation, deregulation, and a less restrictive monetary policy. Fast-forward a few months to April 2025, and the optimism has faded. With capital markets reacting negatively to renewed trade war fears, over $5 trillion in market value were erased in a couple of days.

2025 opened with headlines proclaiming a venture capital comeback.

On paper, VC funding rebounded, driven by an unprecedented surge in AI investment. But beneath the surface, it’s a tale of two markets: one propelled by billion-dollar mega-deals in Artificial Intelligence, and another still struggling to regain traction amid macroeconomic uncertainty, investor hesitation, and a lingering liquidity crunch.

With Trump reigniting trade wars, tariffs reshaping global supply chains, and AI advancing at breakneck speed, it’s becoming harder than ever to place clear bets.

The real question is: what are you going to bet on?

8alpha.ai is an AI investment company transforming cash-generating businesses into scalable, AI-powered companies. We provide revenue-based financing and hands-on AI transformation, delivering no zeros with unlimited upside.

Become part of our revolution.

Happy reading,

8alpha.ai’s Research & Investment Team